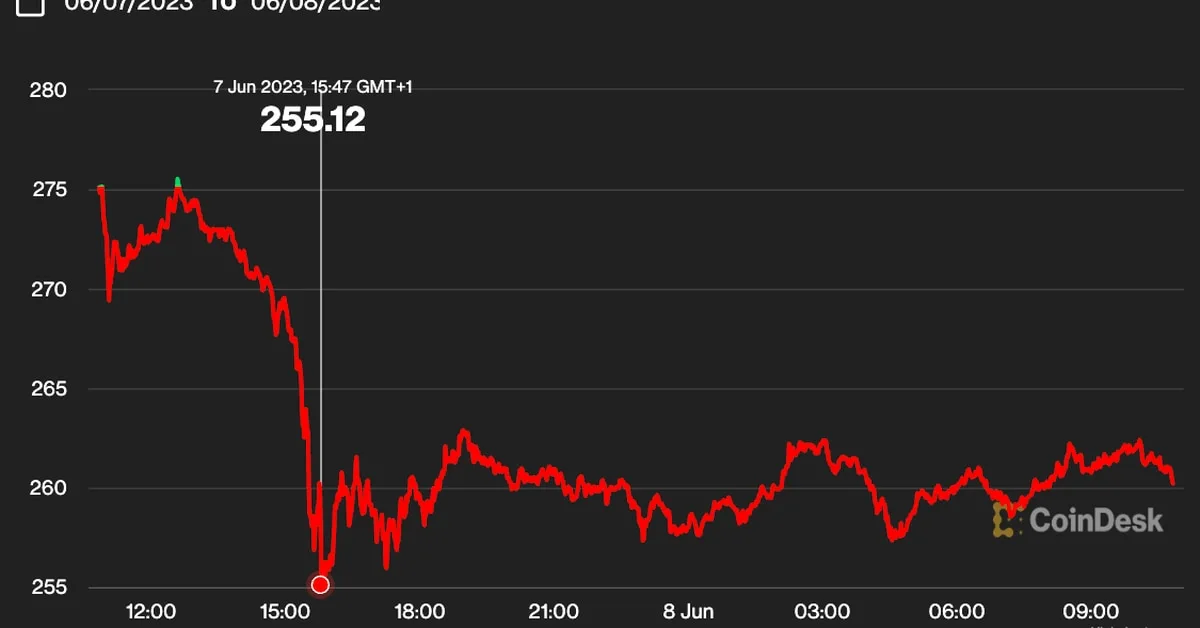

Crypto prices continued to drop as major cryptocurrencies targeted as unregistered securities in U.S. Securities and Exchange Commission (SEC) lawsuits against Binance and Coinbase remain in decline. BNB, the Binance Smart Chain’s native token, dropped 5% in the last 24 hours to a five-month low of $252, according to market data. Algorand’s ALGO lost 8% over the same period, and Solana’s SOL slid 5.2%. Bitcoin has remained somewhat of a safe haven, but only on a relative basis. The cryptocurrency is down modestly over the past 24 hours, but still remains near a three-month low at $26,400.

Despite the lawsuits, Coinbase (COIN) will continue operating its crypto staking service. CEO Brian Armstrong said Wednesday at the Bloomberg Invest Conference, “We’re not going to wind down our staking service. As these court cases play out, it’s really business as usual.” Armstrong noted that the exchange’s staking service accounts for about 3% of Coinbase’s overall net revenue.

The SEC and a ten-state coalition led by the Alabama Securities Commission have both taken aim at Coinbase, with the SEC alleging the company sold unregistered securities and the coalition alleging the company’s staking program had violated various state securities laws.

As a private citizen in 2019, current SEC Chair Gary Gensler offered to serve as an advisor to Binance, lawyers for the exchange told SEC officials on June 4, according to a court filing yesterday. Binance’s attorneys argued that Gensler should recuse himself from the case because of this history. In March 2019, according to the Binance attorneys, Binance CEO Changpeng CZ Zhao and Gensler had an in-person lunch meeting in Japan where they discussed the BNB token and Binance opening an exchange in the U.S.