The long-awaited Hinman docs have finally been unsealed, a move that some believe could play a crucial role in the ongoing legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple. Ripple is being sued by the securities regulator for an allegedly illicit sale of $1.3 billion worth of XRP, a cryptocurrency the SEC is treating as a security. CEO Brad Garlinghouse yesterday said the document dump was well worth the wait. While not everyone is convinced the newly-released files prove Ripple’s claims, the hundreds of internal messages from SEC higher-ups do show that the SEC has never really been clear on whether and how to regulate the cryptocurrencies that were created after Bitcoin.

It all started in 2018, when then Director of the SEC’s Corporate Finance Division William Hinman gave a speech at a Yahoo! Summit, where he argued that ether (ETH), the native token of the Ethereum blockchain, should not be classified as a security—essentially because the network had become sufficiently decentralized from its time of creation. Even if ETH was a security at launch—a very real possibility, the SEC notes, given how the token sale was conducted—blockchain networks can evolve and the circumstances can change.

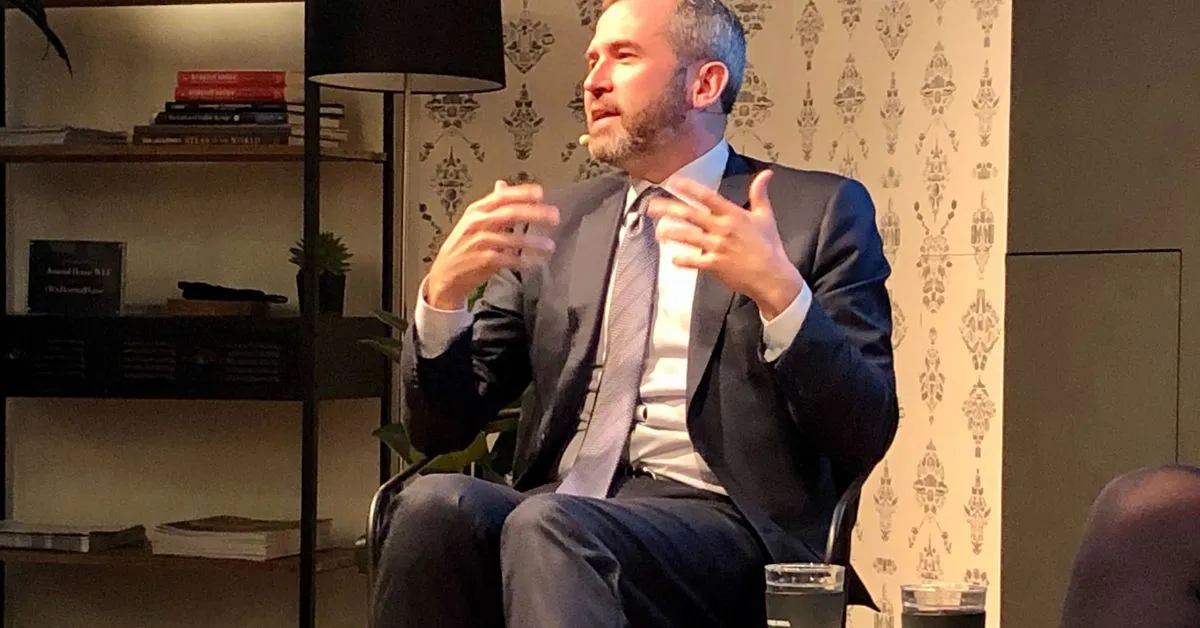

Ripple fought to see these documents and then fought to release them to the public because they sowed discord. On Twitter, Garlinghouse said it’s absolutely unconscionable that Hinman gave his speech despite the lack of consensus agreement within the SEC, adding that the speech deliberately created confusion. This is apparently supportive of the company’s actual defense that the SEC sued Ripple and its executives without a clear legal basis. Further, Ripple is arguing on procedural grounds that the SEC violated its due process rights by failing to provide fair notice of potential securities regulation violations.

For months, the SEC, now run by Chairman Gary Gensler, has fought to keep the Hinman documents out of public view, because his statements were his and his alone, did not represent the agency’s understanding, and are irrelevant to the lawsuit, it argued. However, the internal communications at the SEC concerning Hinman’s presentation—including feedback he solicited from colleagues before the summit—show that many SEC officials were aligned.

Ripple argues a few things about XRP. First, the for-profit company has for years said that it did not create the network or the token, although it is a primary developer on the chain and perhaps the organization that stands to gain the most materially from XRP’s adoption. Further, perhaps confusingly, the company has argued that XRP is commodity money, a type of resource that has trade value for a diverse cast of investors, coders, and companies—like bitcoin (BTC) and ether (ETH).

The case specifically involves a legal interpretation of cryptocurrencies as meeting the prongs of the SEC’s Howey Test, which asks whether an investment contract is an investment of money in a common enterprise with the expectation of profit to be derived from the efforts of others. Ripple denies that XRP qualifies as a security, because there was no investment contract and that XRP has more in common with diamonds, gold, soybeans, and cars (i.e., commodities).

Ripple’s case absolutely matters for the future of the blockchain industry. The unsealed Hinman docs could play a crucial role in the SEC vs. Ripple legal battle, as they show the agency has never really been clear on whether and how to regulate the cryptocurrencies that were created after Bitcoin. Ripple is arguing that the SEC violated its due process rights by failing to provide fair notice of potential securities regulation violations, and that XRP is commodity money, not a security.