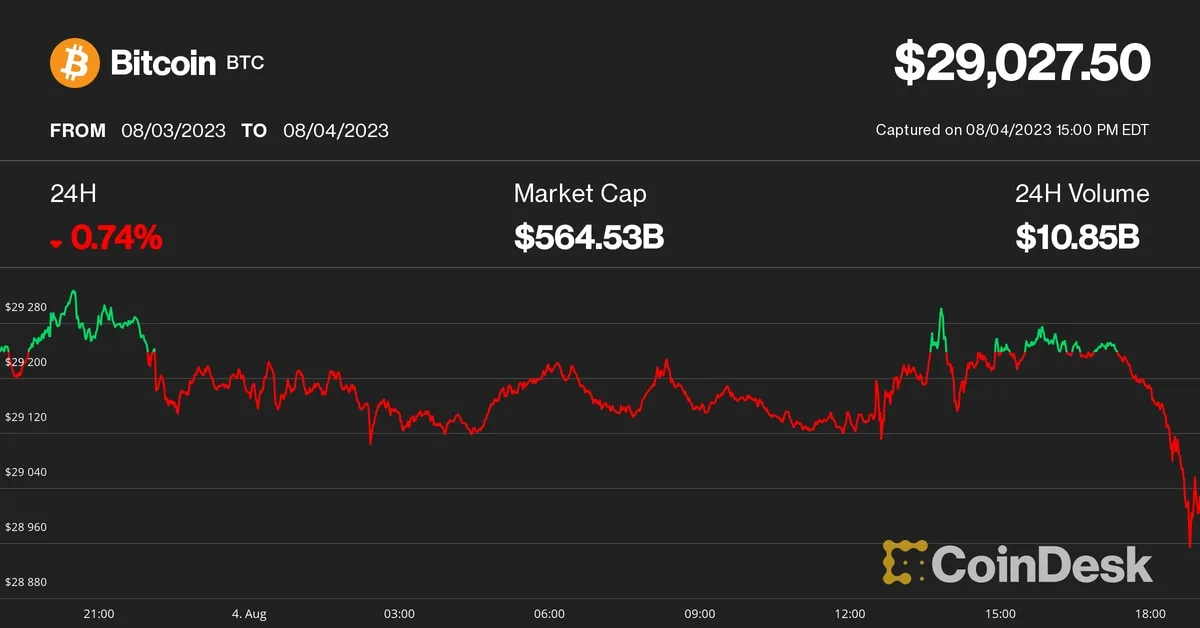

Cryptocurrency markets gave up gains and turned lower on Friday afternoon, with Bitcoin (BTC) buckling to $28,900 before recovering slightly above the $29,000 level. Ripple’s XRP led the downside action among large-cap digital assets, dropping nearly 5% in the last 24 hours and trading at 64 cents, the lowest price since July 13’s partial court win against the U.S. Securities and Exchange Commission. ADA, SOL and MATIC, the tokens of smart contracts platforms Cardano, Solana and Polygon, also reversed, giving up early gains. LTC, the native token of the Litecoin network, extended its losing streak typical around its quadrennial halving event and dropped another 4.5%.

However, some smaller cryptocurrencies defied the otherwise red day in crypto markets. Popular dog-themed token SHIB was up 4% as developers unveiled plans to tie all ecosystem applications to a blockchain-based digital identity. Helium’s HNT surged near 19% during the day, continuing its momentum since the token’s halving day on August 1. The CoinDesk Market Index, a broad measure of crypto market performance, was recently down 1.5%.

U.S. stocks gave up sizable early gains to turn modestly negative by the Friday market close. The government reported the economy as having added 187,000 jobs in July versus forecasts for 200,000, and the unemployment rate slipped to 3.5% versus forecasts for 3.6%. Bob Baxley, a core contributor to DeFi infrastructure provider Maverick Protocol, wrote in an email to journalists, “I suspect that we will trend sideways for a good long while, perhaps for the next several months or even well into next year.” Brent Xu, CEO and co-founder of Web3 bond-market platform Umee, added that crypto prices are unlikely to spike for a prolonged period “until the macro environment softens more.”