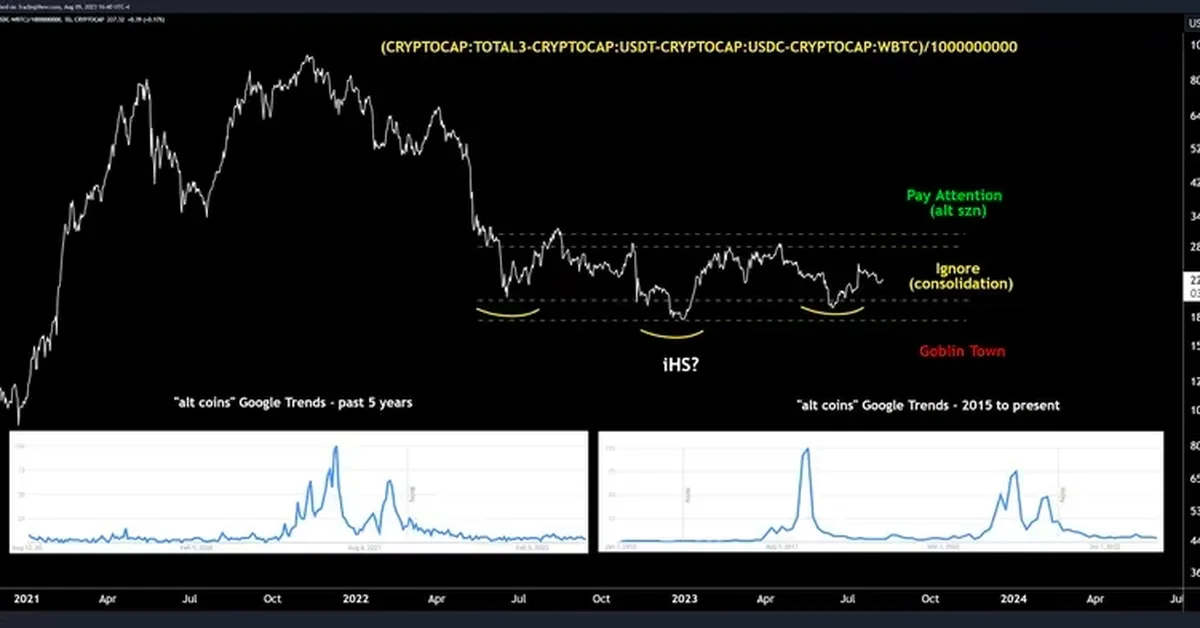

Crypto markets are seeing the formation of a bullish inverse head-and-shoulders price pattern in the combined market capitalization of altcoins. According to Josh Olszewicz, a crypto trader and former researcher at Valkyrie Investments, this pattern could signal an alt season, or outperformance of alternative cryptocurrencies relative to Bitcoin and Ether. The inverse head-and-shoulders pattern is one of the most trusted bullish technical analysis patterns in the market, and is formed when an asset chalks out three price troughs, with the middle one being the lowest. A breakout or a bearish-to-bullish trend change is confirmed once prices rise above the trendline (neckline), connecting the peaks between the lows.

In other news, crypto exchange Bittrex settled charges of offering U.S. investors access to unregistered securities on Thursday, agreeing to pay a $24 million fine within two months of filing a liquidation plan for the exchange. The SEC has brought similar charges against Coinbase (COIN) and Binance.US, and further alleged that Bittrex directed crypto issuers to delete public statements that could suggest their tokens might violate securities law.

Meanwhile, Coinbase’s new Base blockchain saw muted inflows on the first day after its official launch, with just over $10 million transferred to the new blockchain in the past 24 hours. Wallet analysis shows most Base users transferred between $500 to $1,000 worth of Ether on average.

Quotes: A potential completion of the pattern would signal ‘alt season,’ or outperformance of alternative cryptocurrencies relative to Bitcoin and Ether, and The SEC has brought similar charges against fellow crypto exchanges Coinbase (COIN) and Binance.US.