PayPal’s recent launch of a stablecoin under the New York Department of Financial Services regulatory framework has drawn the attention of Rep. Maxine Waters (D-CA), who declared she was deeply concerned with the payments giant’s move. This moment has echoes of the battle over the doomed Libra project, which Waters also opposed. However, the circumstances are quite different from four years ago, when Facebook, now known as Meta, rolled out a basket-based stablecoin to a barrage of regulator criticism.

The opposition to Libra was so strong that it ultimately stymied the project’s advance, leaving it to wither and die, even after a radical redesign and a name change to Diem. Libra was one of those rare issues that generated bipartisanship – in opposition to the project, rather than for it.

In contrast, the stablecoin industry now seems to have won over a decent number of backers in Congress, mostly from one side. Last month, House Republicans successfully pushed stablecoin legislation through the House Financial Services Committee. PayPal’s move has complicated the outlook for this bill’s passage through the Senate, as observers argue that it will harden the resolve of the party’s anti-crypto crusaders in the Senate, such as Sen. Elizabeth Warren (D-MA).

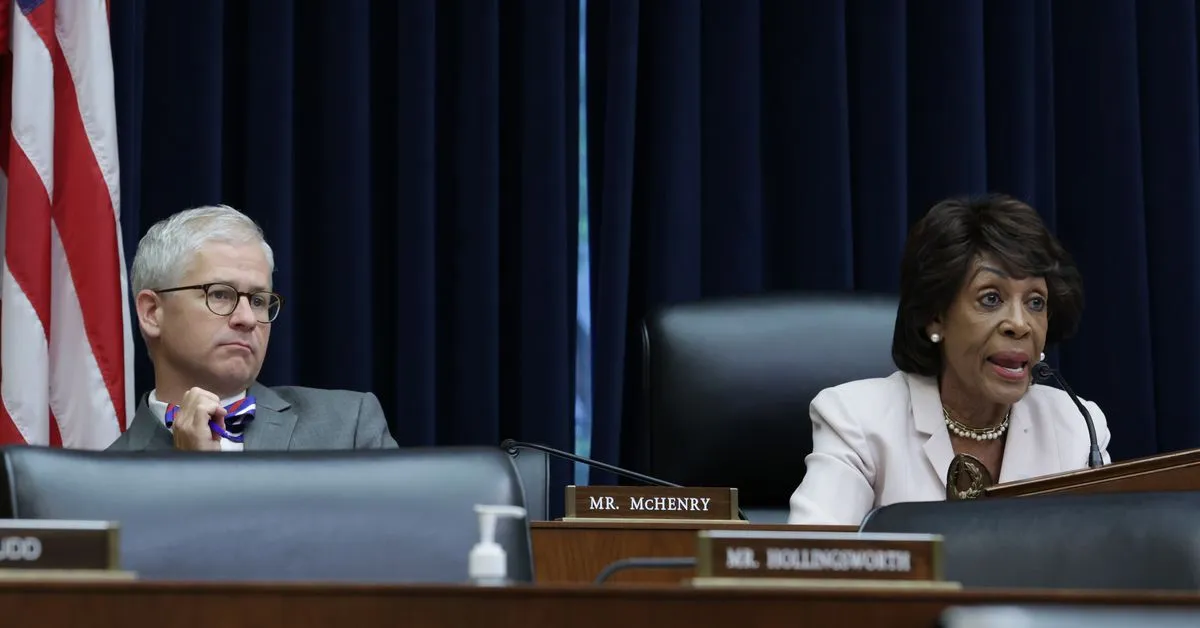

However, PayPal’s project is in a far stronger position politically than the universally mistrusted Libra ever was. Republicans are thrilled that the payments company launched its stablecoin, known as PYUSD, at this moment. The bill’s sponsor, Rep. Patrick McHenry (R-N.C.), chairman of the House Financial Services Committee, called the move a clear signal that stablecoins – if issued under a clear regulatory framework – hold promise as a pillar of our 21st-century payments system and made it more important than ever to keep moving the legislation forward.

Financial establishment players such as BlackRock, Fidelity, Invesco, Charles Schwab, Fidelity, and Citadel are now pushing the Securities and Exchange Commission to support newly revived submissions seeking approval of Bitcoin exchange-traded funds (ETFs) and a new crypto exchange. PayPal’s dollar-only stablecoin could boost demand for the U.S. currency around the world and, with six Democrats breaking ranks in the House Financial Services Committee to support a separate McHenry-sponsored bill that creates a broad regulatory framework for crypto, the risk of gridlocked stalemate might not be as high as feared.