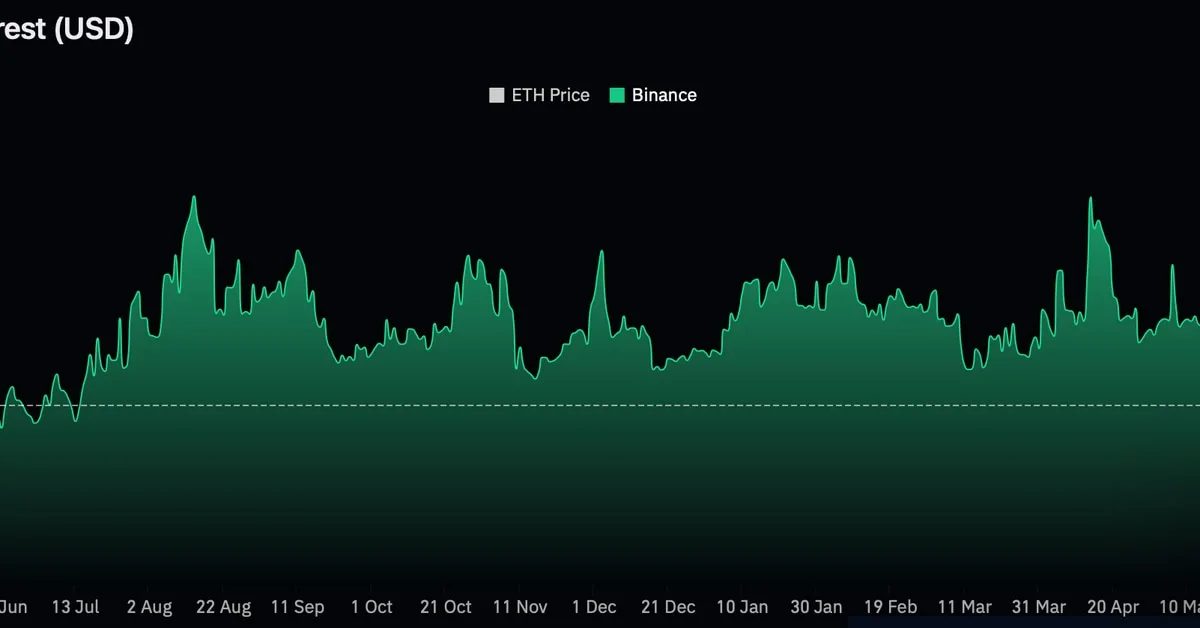

The value of US dollars locked in active ether perpetual futures contracts listed on Binance has dropped to its lowest point in 13 months. According to data tracked by Coinglass, the notional open interest was $1.41 billion at press time, the lowest since July 2020. Binance is the world’s largest digital asset exchange by trading volume and open interest in both spot and futures markets.

In the past week, the notional value in ether futures on Binance has decreased by 35%, mirroring the market-wide leverage washout seen since last Thursday. The notional open interest in the exchange’s bitcoin perpetual futures has also dropped 17% to $3.02 billion. Reflexivity Research commented in a market weekly market update, On the bright side, this excess leverage in the derivatives market has now been flushed out of the system.

The global estimated leverage ratio for ether, calculated by dividing the dollar value locked in the active open perpetual futures contracts by the total number of coins held by derivatives exchanges, has gone from a multi-month high of 0.28 to 0.22. Bitcoin’s ratio has decreased from 0.27 to 0.21, the lowest since May, according to data tracked by CryptoQuant. This indicates that the degree of leverage used to amplify returns is significantly lower than a week ago, and thus a lower probability of liquidations-driven volatility in the coming weeks.

Marex Solutions’ co-head of digital assets, Ian Solot, said in an email, Don’t read much into the recent move; it was exceptionally low liquidity + leverage liquidation. Technicians will draw lines and commentators will peddle their preconceived views. But it was a typical positioning reset, especially for BTC. Moving on.