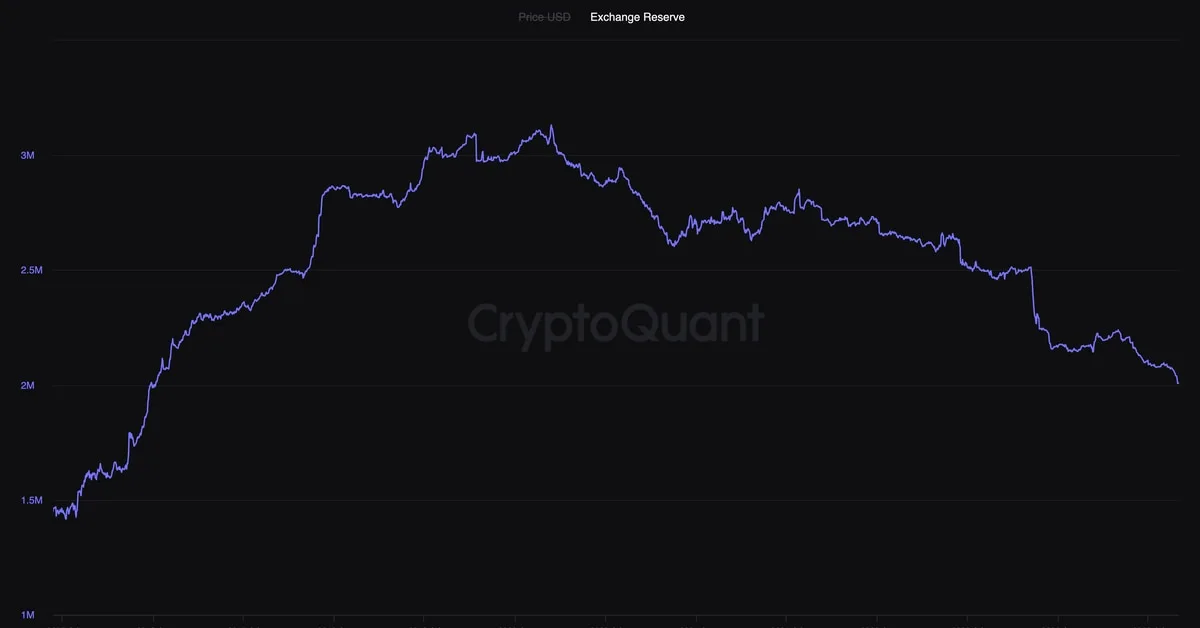

The number of Bitcoin (BTC) held in addresses tied to centralized exchanges has dropped to its lowest level in more than five years, according to on-chain data analytics service CryptoQuant. This 4% decrease to 2 million BTC ($54.5 billion) this month partly reflects the increased demand for services like Copper’s Clearloop, which requires only a minimum of coins to be posted on exchanges, said Markus Thielen, head of research and strategy at Matrixport. This is a natural progression of the crypto market where exchanges will have to work with lower balances, he added.

The decline in exchange reserve is partially due to the rising popularity of services like crypto custodian Copper’s ClearLoop, which allows users to trade without moving funds to centralized exchanges. This is in response to the misuse of customer funds through the FTX leadership, which reminded investors about the importance of self-custody, according to Thielen. A PricewaterhouseCoopers’ report published last month showed that most industry players now prefer multiple forms of custody, with only 9% of the respondents leaving coins exclusively on exchanges.

The dwindling exchange balance could indicate investor preference for taking direct custody of coins to hold them for the long term in anticipation of a price increase. This could be seen as a sign of investor confidence in cryptocurrency’s long-term prospects. Thielen believes that after the 2022 price declines, investors are taking a buy-and-hold investment approach.