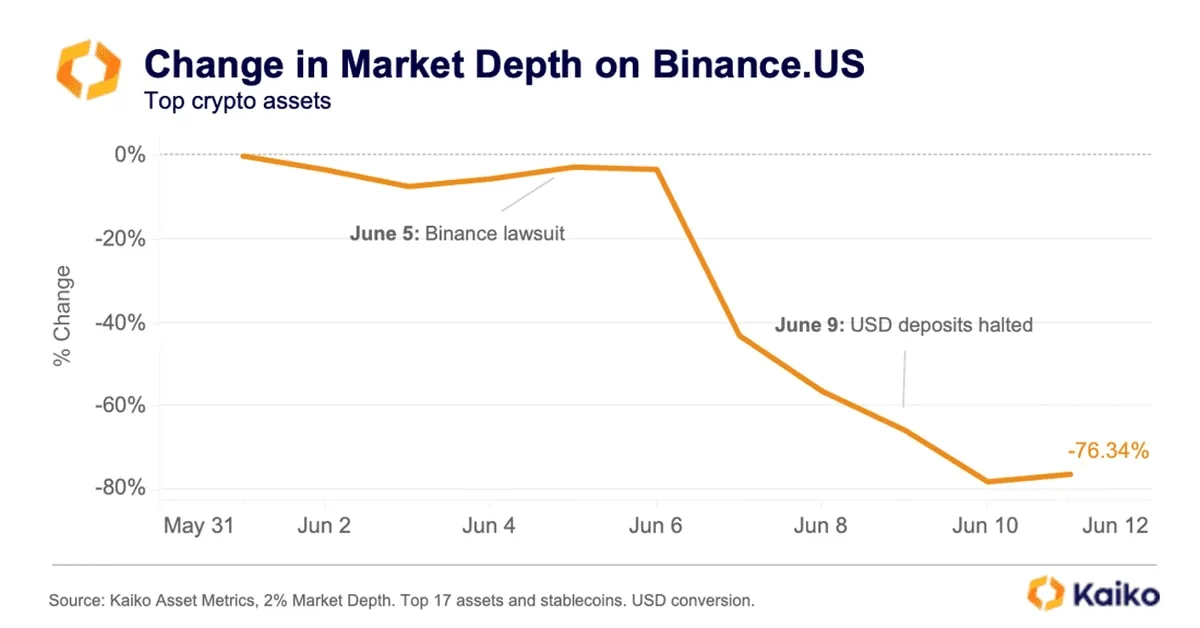

Following the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Binance.US last week, market makers and traders have been fleeing the exchange en masse. According to a report by Kaiko, liquidity, measured by aggregated market depth for 17 tokens on Binance.US, has dropped 76%. The U.S. arm of Binance also saw its U.S. market share drop to 4.8% from 20% in April.

The day before the lawsuit, June 4, market depth was at $34 million, whereas on Monday, market depth was at $7 million. Binance global also witnessed a drop in market depth, decreasing 7% since the start of June. “Binance’s market depth initially held steady, even increasing in the immediate aftermath of the lawsuit, but over the weekend fell as altcoin markets sold off,” said the Kaiko report.

Not only Binance.US, but U.S.-based Coinbase, which was also sued by the SEC last week, saw its liquidity drop by 16% over the same time period. “The sharp drop in liquidity suggests market makers are nervous and want to avoid volatility-induced losses and the non-negligible possibility that their assets could get stuck on an exchange à la FTX collapse,” said the Kaiko report.

Interestingly, Coinbase’s market share increased over the past week from 46% to 64%, for reasons that are unclear, said Kaiko.