The cryptocurrency’s price jumped to $30,800 on Wednesday, the highest since April 14, cheering the recent flurry of spot bitcoin ETF applications by BlackRock (BLK), WisdomTree and Invesco (IVZ), which highlighted a sustained institutional appetite for the world’s largest cryptocurrency, said Lin Chen, Deribit’s Asia business development personnel. We have seen the biggest trading volume in three months. There is a lot of interest in buying call options.

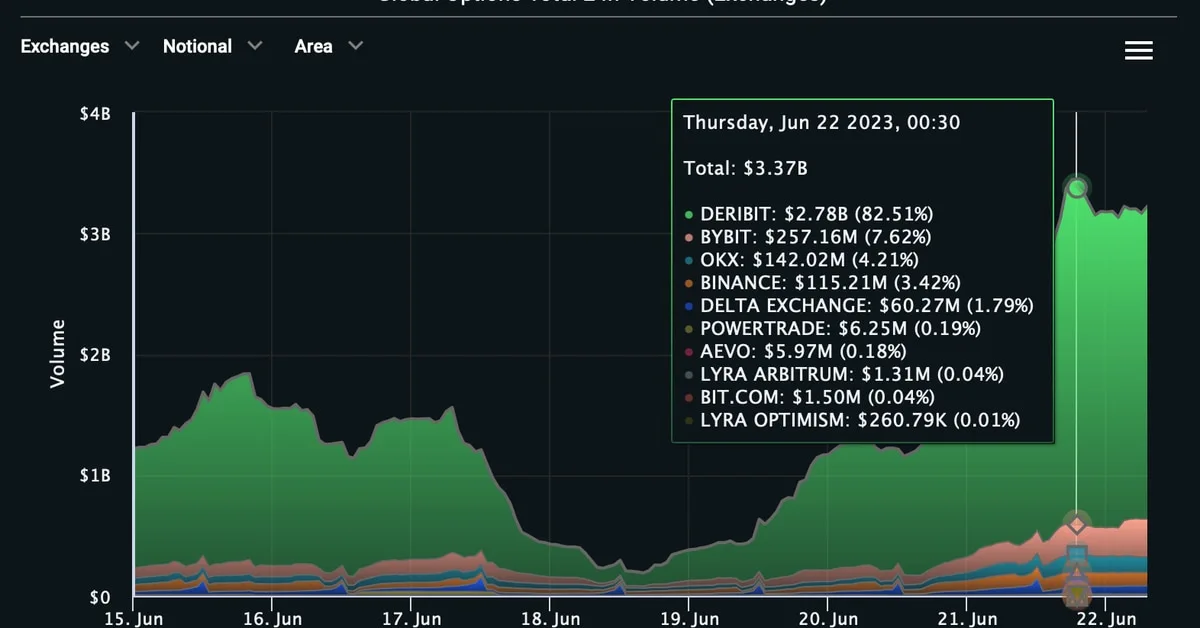

The recent surge in Bitcoin’s (BTC) price to two-month highs has caused a surge in demand for call options and increased activity in the options market. On Wednesday, bitcoin options contracts worth $3.3 billion changed hands across major exchanges, including Deribit, the highest single-day notional volume in three months. Call options at strike prices of $30,000, $31,000, $32,000 and $40,000 have been popular among traders in the past 24 hours, per Laevitas.

The increased demand for options has pushed Deribit’s bitcoin volatility index, DVOL, to 59.24, the highest since early April, per Amberdata. The DVOL measures bitcoin’s 30-day implied volatility (IV) calculated using Deribit’s options order book. The higher the demand for options, the higher the IV and vice versa. The IV refers to investors’ expectations for price turbulence over a specific period.

The DVOL is moving reactively on the recent headlines and the last three days’ spot move. Prices were very contained in the recent two months and realized volatility has been low overall. The market was caught a bit short [volatility] going in and people are scrambling to cover, said Patrick Chu, director of institutional sales and trading at Paradigm.

In the past seven days, call spreads have accounted for 45% of the total block flows. Block trades are large orders executed on over-the-counter liquidity networks like Paradigm and then listed on exchanges.