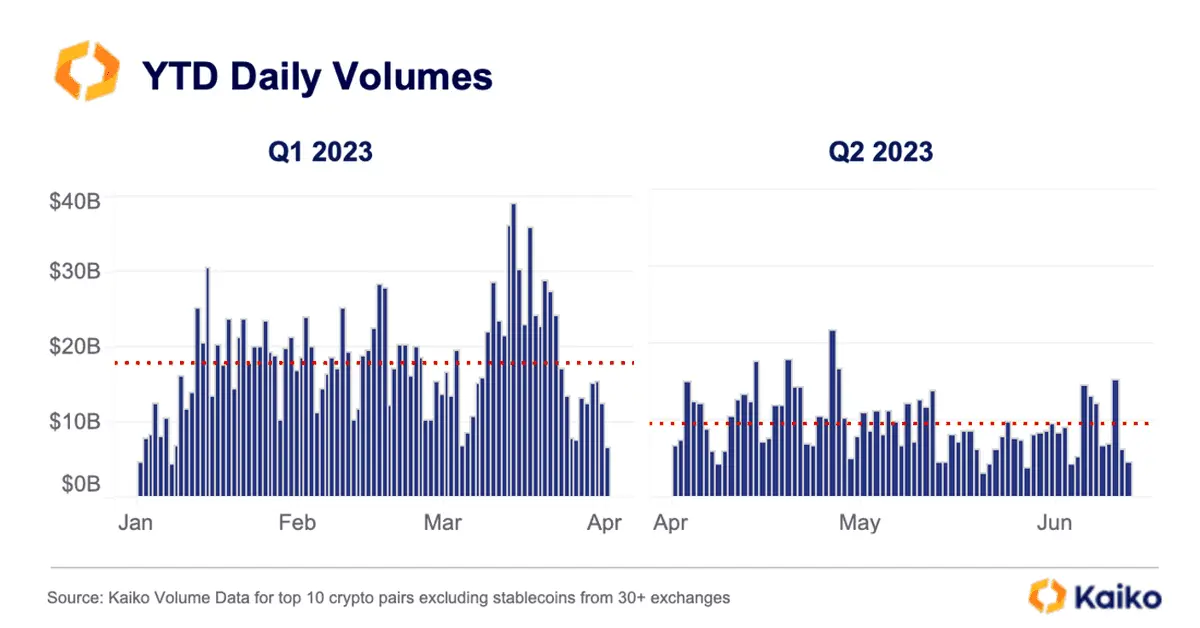

Data from Kaiko shows that crypto trading volumes have hit yearly lows in the second quarter of 2023, with average daily volumes for the top 10 tokens (excluding stablecoins) dropping from $18 billion in the first quarter to $10 billion. This decrease in trading activity is likely due to the recent regulatory crackdown, with major exchanges such as Binance and Coinbase facing lawsuits from the US Securities and Exchange Commission (SEC).

In terms of individual token market share of trading volume, bitcoin has seen a 20 percentage-point decrease since its peak at the end of March. Ether, however, has seen a 5 percentage-point increase in share of volumes. Binance’s BNB token has also seen a significant rise, increasing from 2% of volumes to over 7% in the last few days.

Quotes: Average daily volumes for the second quarter of 2023 were $10 billion for the top 10 tokens (excluding stablecoins), compared to $18 billion average daily volumes in the first quarter of the year. In terms of individual token market share of trading volume across Q2, bitcoin has lost around 20 percentage points since its peak at the end of March. Ether outperformed bitcoin, taking a 5 percentage-point increase in share of volumes. Binance’s BNB rose from 2% of volumes to over 7% in the last few days amid the Binance regulatory fear.