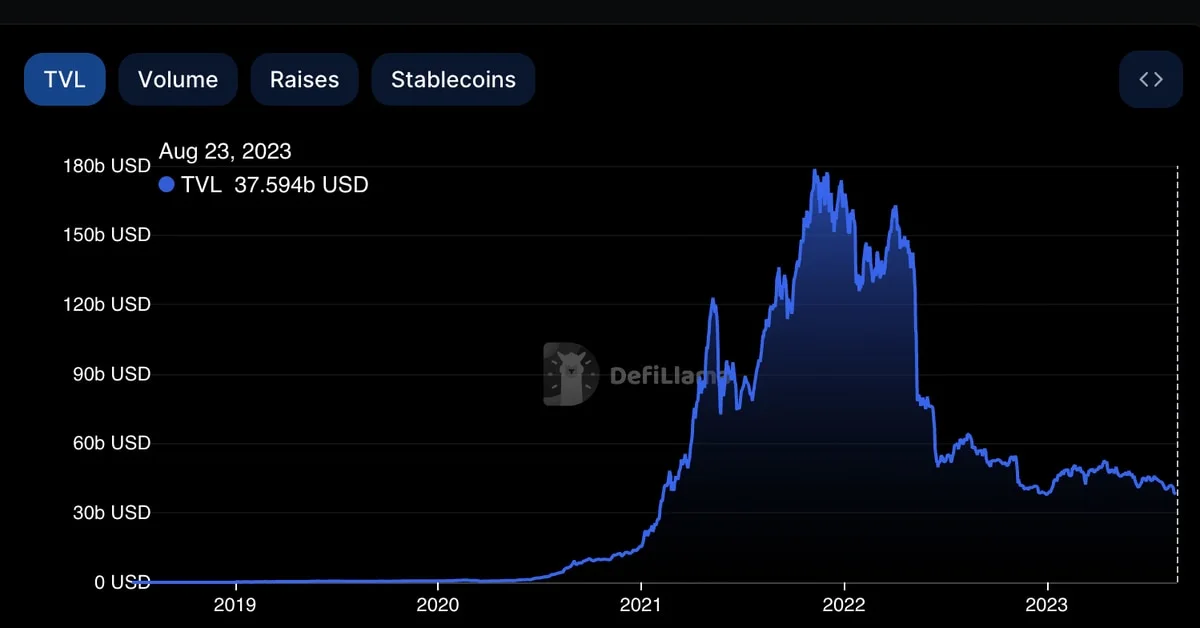

The total value locked (TVL) in decentralized finance (DeFi) protocols has dropped to its lowest level since February 2021, according to data compiled by DefiLlama. This slump to $37.5 billion is below the previous post-bull market nadir of $38 billion set in December. Despite the hype around DeFi ushering in a new way of doing finance, the U.S. government’s crackdown on crypto has made traditional finance players wary of the space. Several protocols have lost more than half of their locked value in the past month alone, with Velodrome’s TVL dropping 58% and Balancer’s TVL decreasing 35% to $641 million.

The recent decline in crypto prices has caused traders to pull liquidity out of more speculative assets like those within DeFi to mitigate risk. However, DeFi has fared worse than Ethereum’s ether (ETH) this year, which is up 40% since December. Doo, co-founder of StableLab and Asia Lead at MakerDAO, suggested that DeFi’s sensitivity to yields on U.S. Treasuries is a factor in the decline. Fundamentally, it’s due to U.S. Treasury yields being up and DeFi yields, which are higher risk, giving lower rewards, Doo said. There is a wider issue with liquidity as well and this can be verified by looking at overall volumes of major decentralized exchanges.