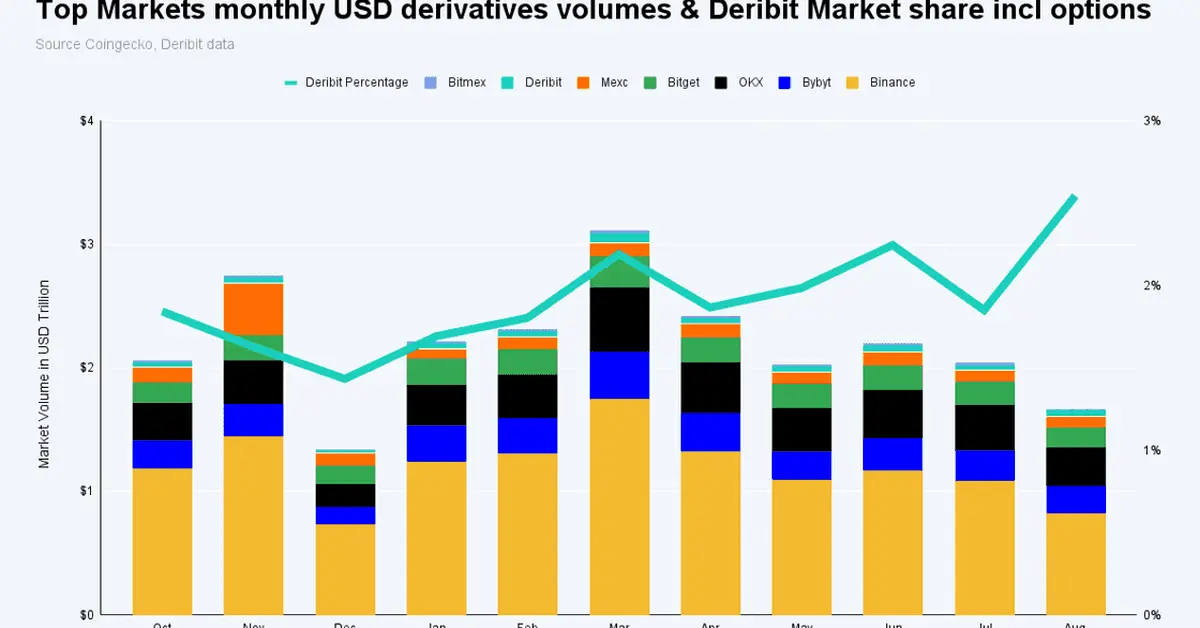

Deribit, a Panama-based crypto derivatives exchange, saw a 17% increase in its derivatives market volume in August, reaching $42 billion. This was in stark contrast to the global downtrend, which saw worldwide derivatives volumes decline 12.1% to around $1.6 trillion. According to Deribit’s Chief Commercial Officer, Luuk Strijers, the resilience can be attributed to the strong performance of our options segment.

The exchange saw a surge in demand for call and put options, as Bitcoin (BTC) experienced violent price swings between $25,000 and $30,000. This triggered massive liquidations in futures and options on Deribit, and caused the Bitcoin implied volatility index (BTC DVOL) and similar ETH-focused gauge to surge to 53% and 50%, respectively.

More than 5.6 million Ether (ETH) option contracts, worth $9 billion at the ETH’s current market price of $1,624, changed hands last month. This was the highest single-month tally since March. Additionally, about 0.7 million BTC options contracts were traded.