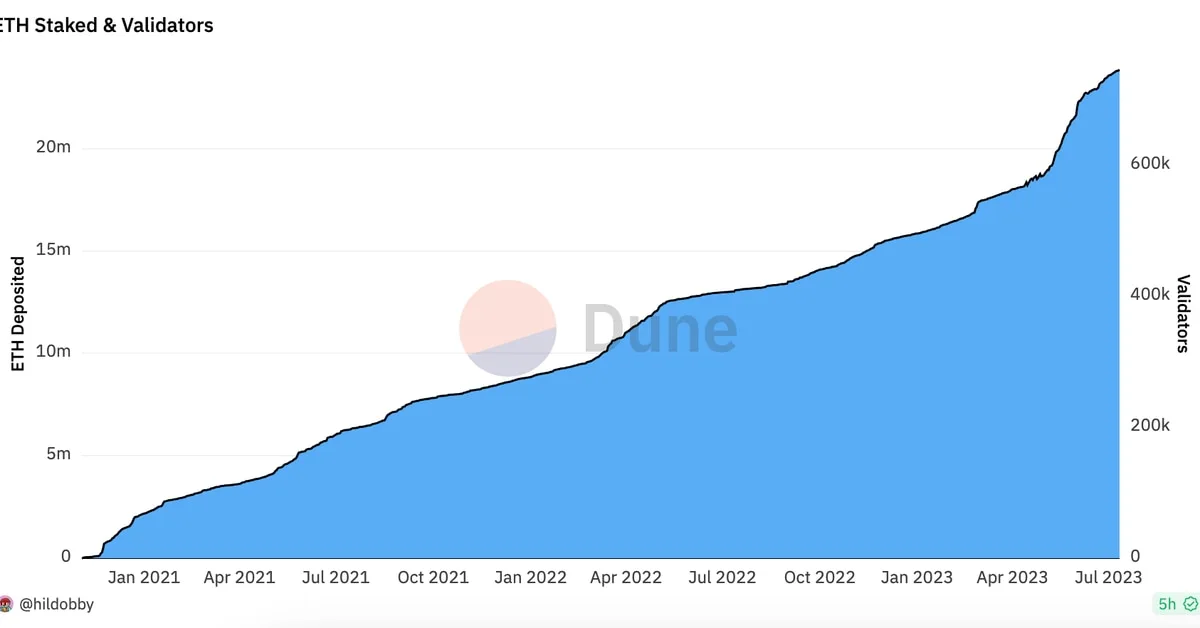

Ether (ETH) staking has reached a key milestone of 20% of all tokens locked up in staking contracts, but inflows have slowed after an initial rush as investors become more cautious about regulatory risks. According to a Dune Analytics dashboard by Hildobby, 23.9 million ETH have been deposited to Ethereum’s staking network, including tokens committed and waiting in a queue. This accounts for roughly a fifth of the token’s 120 million supply.

The Shanghai upgrade, which allowed withdrawals from its proof-of-stake network starting in April, sparked fresh demand to stake the second largest cryptocurrency. Staking lets crypto owners lock up tokens to participate in securing the network as a validator in exchange for a reward, making it a popular investment among long-term investors including institutional investors. Since the upgrade, deposits have far outpaced withdrawals by 4.5 million, worth $8.4 billion at the current price.

However, the pace of inflows slowed last month compared to the initial surge. Tom Wan, research analyst of digital asset investment product firm 21Shares, said in a note, “The slowdown is likely to be driven by regulatory scrutiny on centralized exchanges.” Early June was “a key turning point” for inflows, Wan noted, when the U.S. Securities and Exchange Commission (SEC) sued crypto exchanges Binance and Coinbase. The agency alleged that the platforms, both among the largest ETH staking services, offered unregistered securities with their staking service.

The tokens transferred to staking do not earn rewards until they are stuck in the queue, lowering the effective annualized yield, according to John “Omakase” Lo, managing partner of investment firm Recharge Capital. However, Katie Talati, head of research at digital asset investment firm Arca, said that the validator queue is less likely to affect inflows. “Investors are more concerned with the unstaking queue, or how long it takes to remove money from ETH staking.”

Risks around centralized staking services have likely driven investors to decentralized solutions. Talati pointed out, “We have seen a large amount of growth in staked assets with decentralized staking protocols such as Rocketpool and Lido.” The two decentralized liquid staking protocols grew by 5.4% and 6.3%, respectively, through the past month, outpacing Coinbase and Binance.