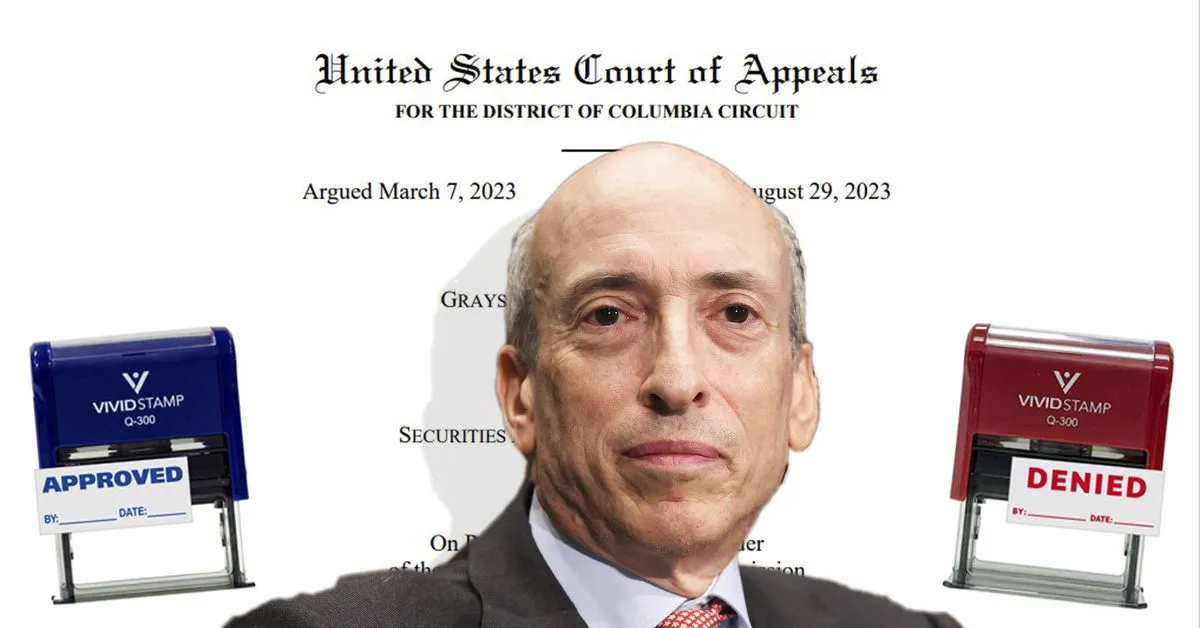

The crypto industry’s campaign to set up exchange-traded funds (ETFs) has now pushed the U.S. Securities and Exchange Commission (SEC) against a wall with Grayscale Investments’ consequential court win. Dan Berkovitz, former general counsel at the agency, said, “It’s back in the SEC’s court. If SEC officials wanted to deny Grayscale’s bitcoin ETF again, “they’d have to really think of some other reasons that they haven’t articulated yet. That would be a hurdle for them.” The SEC, led by Chair Gary Gensler, now faces several options: appeal the decision, grant Grayscale’s application to list its bitcoin spot ETF, let it be automatically approved by doing nothing, or start up a new, second effort to reject the application based on fresh objections.

The U.S. securities regulator has said after the ruling that it’s “reviewing” the court action and will make a decision on its next steps. Pat Daugherty, a former SEC lawyer who now represents crypto clients with Foley & Lardner, said, “‘Arbitrary and capricious’ are not words that Gary Gensler should want to hear from federal courts, but that’s what this unanimous panel of judges called his agency’s judgment. The SEC failed to explain why it could approve ETFs based on bitcoin futures but not an ETF based on bitcoin. Since like cases must be treated alike in America, the SEC lost.”

At stake is an investment product that could bring new investors to crypto but that the SEC has said is still too hazardous. Jake Chervinsky, chief policy officer for the Blockchain Association – a crypto lobbying group – said in a series of tweets on the decision, “One theory is that the SEC will just pick a different reason to deny Grayscale’s proposal and force more long and costly litigation. But another theory is that the SEC will take the DC Circuit’s decision as a (semi-)graceful exit from their anti-ETF position. I’m in this camp. It’s the right move.”

Grayscale is a unit of Digital Currency Group, which is also the parent of CoinDesk. Dave Weisberger, co-founder and CEO of CoinRoutes, predicted, “The SEC could now decide to approve the projects with good surveillance plans and call it a win for consumer protection.” Coinbase (COIN) chief legal officer Paul Grewal said, “The courts are giving us regulatory clarity where the SEC has refused.”

Justin Slaughter, who has worked at the SEC and is now the policy director at Paradigm, said, “I’ve never before seen a financial regulator’s denial of an application get slapped down by a bipartisan judicial panel of a moderate, a conservative, and a progressive like just happened in Grayscale. The SEC has restored bipartisanship in DC.”

Whether or not Grayscale wins in the end, the ruling may lift the other ETF efforts. Dennis Kelleher, CEO of Better Markets, said, “The decision does not change the fact that the Bitcoin market is subject to fraud and manipulation or that an ETF would be a serious threat to investors, which is why the SEC did and should deny Grayscale. The SEC should consider rescinding the prior unwarranted Bitcoin futures ETF approvals.”