The share of bitcoin trade volume on Japanese exchanges rose from 69% to 80% in the first six months of the year, said Dessislava Aubert, research analyst at Kaiko. It signals rising appetite on Japanese markets.

The Japanese yen has depreciated sharply since the Federal Reserve (Fed) began its aggressive interest rate hike campaign in March 2022, leading traders from Japan-focused digital assets exchanges to turn to bitcoin (BTC) as a hedge against traditional finance.

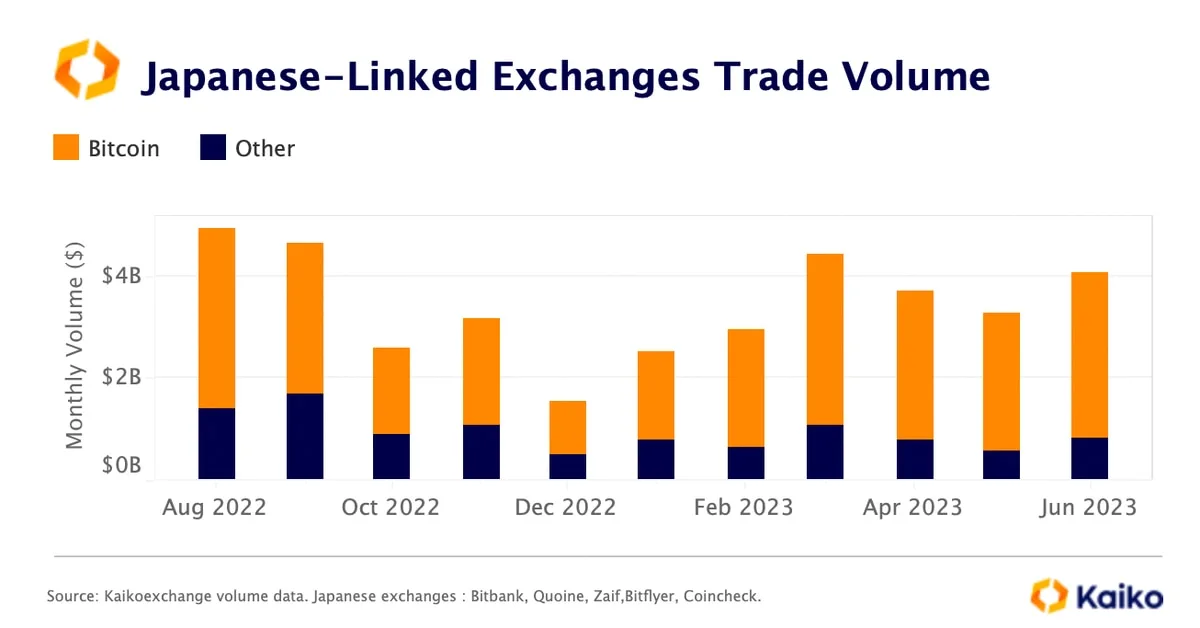

Data tracked by Paris-based Kaiko shows that the total trading volume on Japanese exchanges was $4 billion in June, amounting to a 60% year-to-date surge. The share of the bitcoin-Japanese yen (BTC/JPY) pair in total volume in bitcoin-fiat trading pairs has also increased from 4% to 11% this year.

Bitcoin is widely considered a digital gold and a hedge against traditional finance and fiat currencies, and its value has surged 84% to over $30,000 this year while trading at a premium on Japanese exchanges.

The yen volatility will likely persist as speculation is simmering that the Bank of Japan could announce a hawkish tweak to its policy next week. Inflation is also rising in Japan, and a key gauge that excludes energy components recently hit a four-decade high.

The chart shows trading activity on Japan-focused exchanges has picked up faster than Korean markets and the Nasdaq-listed Coinbase exchange. Japan already has a regulatory framework, unlike the U.S. where authorities still rely on enforcement to oversee the industry.