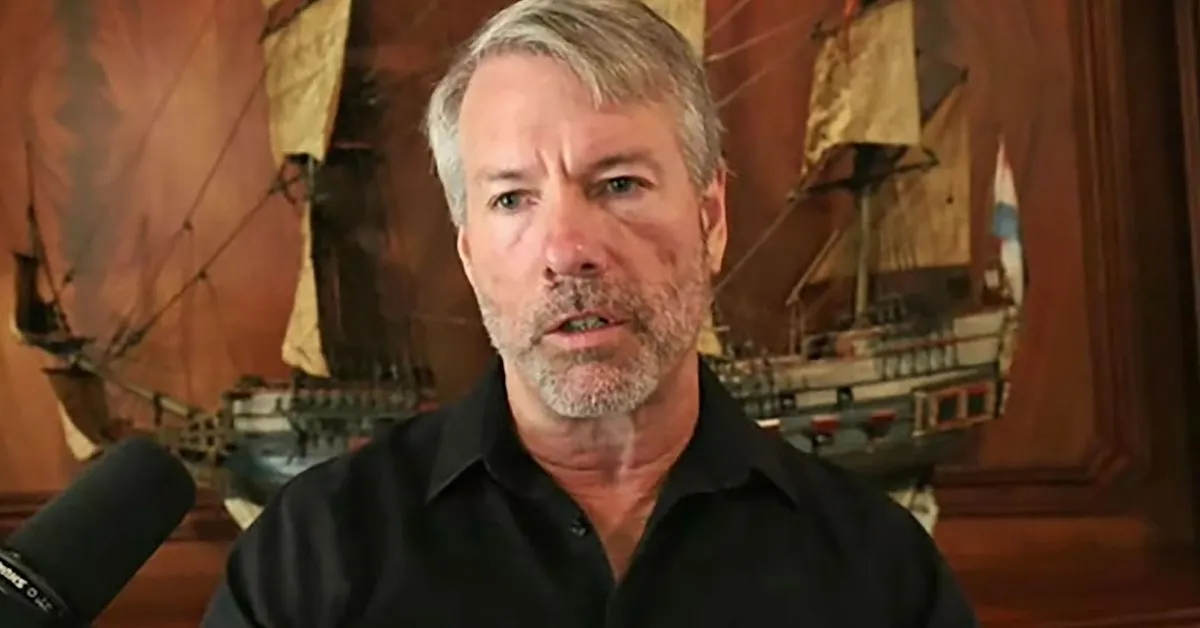

MicroStrategy’s Founder and Executive Chairman Michael Saylor has said that recent enforcement actions by U.S. regulators have made it clear that the crypto industry is destined to be rationalized down to a Bitcoin (BTC)-focused industry. In an interview with Bloomberg on Tuesday, Saylor said, MicroStrategy’s views since 2020 have been that the only institutional-grade asset is Bitcoin. Last week, the U.S. Securities and Exchange Commission (SEC) filed lawsuits against Binance and Coinbase, the two largest crypto exchanges by market cap, and did not include Bitcoin in the filings.

Saylor’s MicroStrategy began buying Bitcoin in 2020 and now holds approximately 140,000 Bitcoin worth about $4 billion. He said that since 25,000 other cryptocurrencies (approximately) have been angling to position themselves as Bitcoin or a better Bitcoin, the public now understands that Bitcoin is the next Bitcoin. He added, Eventually, I have confidence that the crypto exchanges will come around to realizing that Bitcoin really is the dominant asset in this space, and their business models are fine when Bitcoin goes up by a factor of 10.