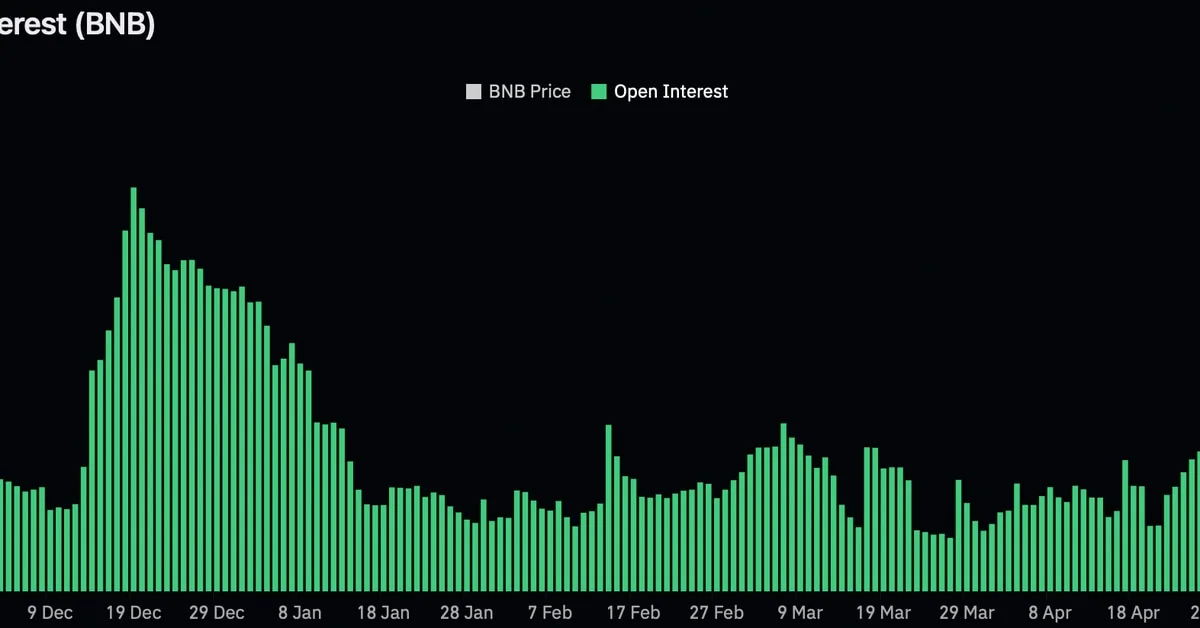

Data tracked by CoinGlass shows that open interest, or the number of unsettled and active futures contracts tied to Binance’s BNB token, continues to rise. On Monday, the total open interest rose to 1.57 million BNB ($360 million), the highest since January 1. This marks an 8% increase in the past 24 hours and a 27% increase in one week.

Despite the rise in open interest, the going market rate for BNB fell to $221 early Monday, nearly matching the low registered on December 12. Prices have declined by over 25% since the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance on June 5.

The increase in open interest alongside a price decrease suggests an influx of short positions or bearish bets, confirming a downtrend. The negative funding rates in the perpetual futures market also indicate a bias for bearish positioning. According to Dubai-based crypto analyst and trader Reetika Malik, “BNB shorted a lot right now cause there’s a on-chain liquidation around $220 on Venus Protocol which could lead to a cascade.”

In response, Venus Protocol put out a tweet before press time, stating that the BNBChain core team will take over the BNB position on Venus if the cryptocurrency hits the liquidation threshold and ensure the cryptocurrency is not dumped into the market.