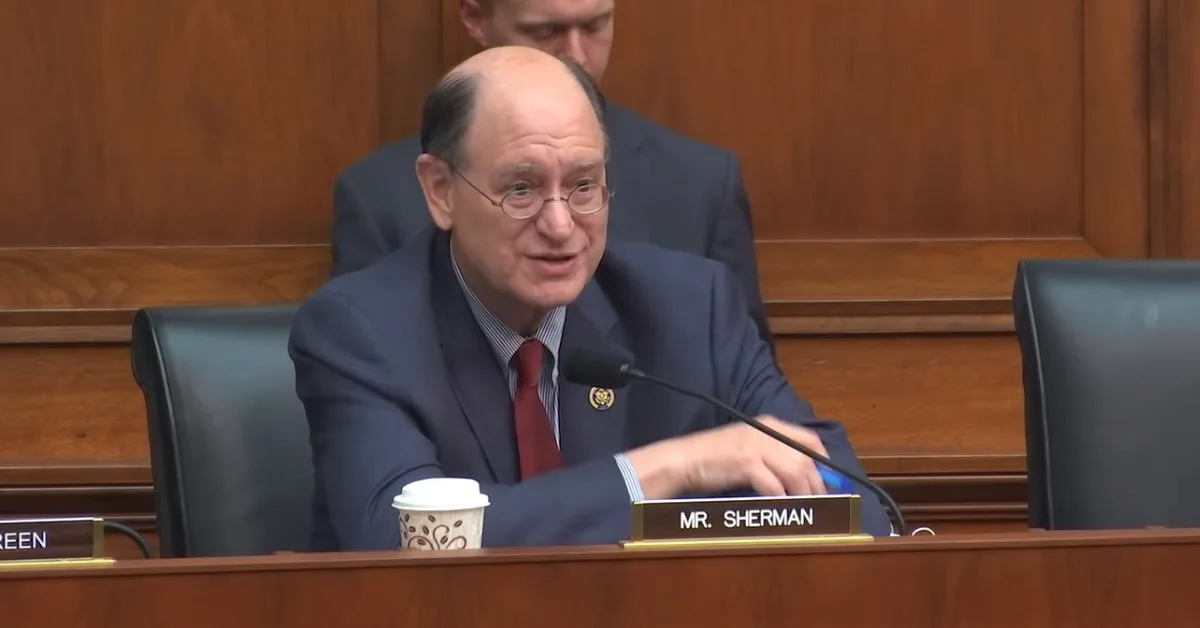

For many years, the cryptocurrency industry has been a major source of tax evasion and a significant part of the nation’s tax gap, said Rep. Brad Sherman (D-Calif.), a senior member of the House Committee on Financial Services. Reps. Sherman and Stephen Lynch (D-Mass.) have now urged the U.S. Treasury Department and Internal Revenue Service (IRS) to promptly release planned crypto tax rules in a Monday letter.

The letter noted that while the White House may have completed the review of the 2021 infrastructure bill’s hotly debated tax reporting requirements for crypto brokers in February, the government has yet to release the proposed regulations. The point of contention was a broad definition of broker that could apply the reporting requirement to miners and crypto wallet providers, who would not be able to comply with the rule.

IRS official Julie Foerster said in April during CoinDesk’s Consensus event that the agency was looking into other ways of communicating with the industry so that taxpayers can voluntarily comply with the reporting requirement. However, the lawmakers’ letter said the crypto industry has had all of 2022 to prepare and now it apparently gets 2023 off as well.