Crypto markets reacted to news that the U.S. Securities and Exchange Commission (SEC) has delayed until October a decision on all spot bitcoin exchange-traded fund (ETF) applications submitted by firms including BlackRock, WisdomTree, Invesco Galaxy, Wise Origin, VanEck, Bitwise, and Valkyrie Digital Assets.

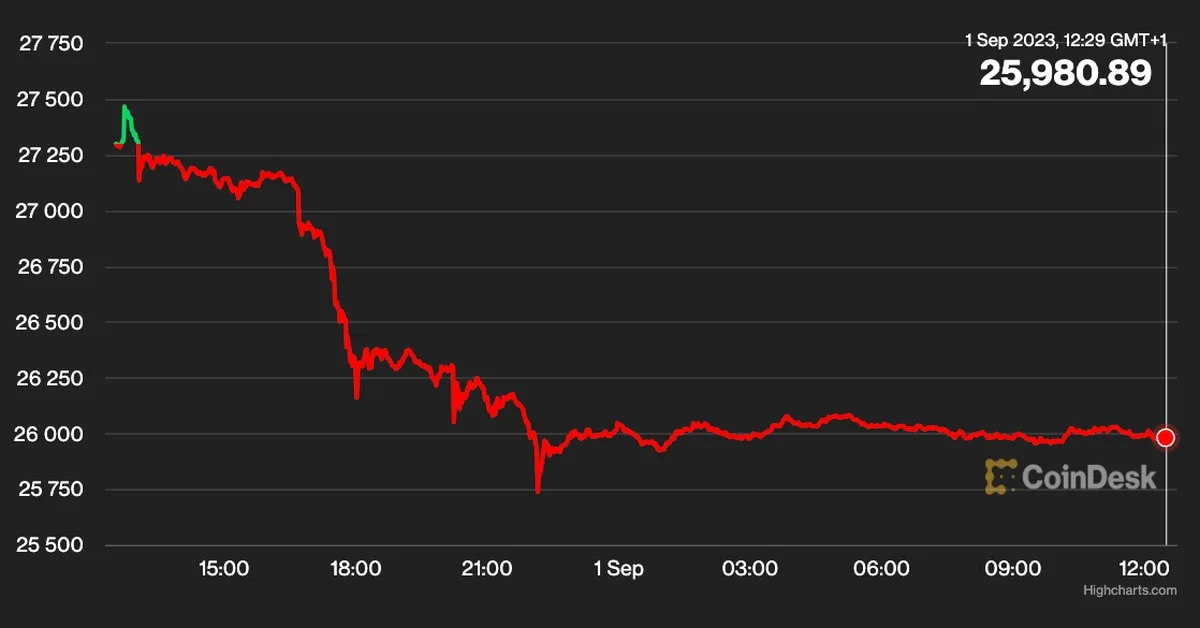

Bitcoin and major tokens gave back all weekly gains as the SEC delayed key ETF decisions that were expected on Friday, damping traders’ hopes of a long-term recovery, according to CoinDesk. The largest cryptocurrency fell under $26,000, with majors Solana (SOL) and Litecoin (LTC) dropping as much as 5.5% while Ether (ETH) lost 3.7%. Bitcoin Cash (BCH) slid 7.7%.

A New York court classified popular cryptocurrencies Ether and Bitcoin as commodities while dismissing a proposed class action lawsuit against leading decentralized crypto exchange Uniswap. Judge Katherine Polk Failla of the Southern District of New York directly called it a commodity and declined to stretch the federal securities laws to cover the conduct alleged, in the case against Uniswap.

The applicants hope to launch the first spot Bitcoin ETF, which advocates have argued will allow for greater retail investment in the Bitcoin market while saving investors the trouble of setting up a wallet or having to buy the cryptocurrency directly.