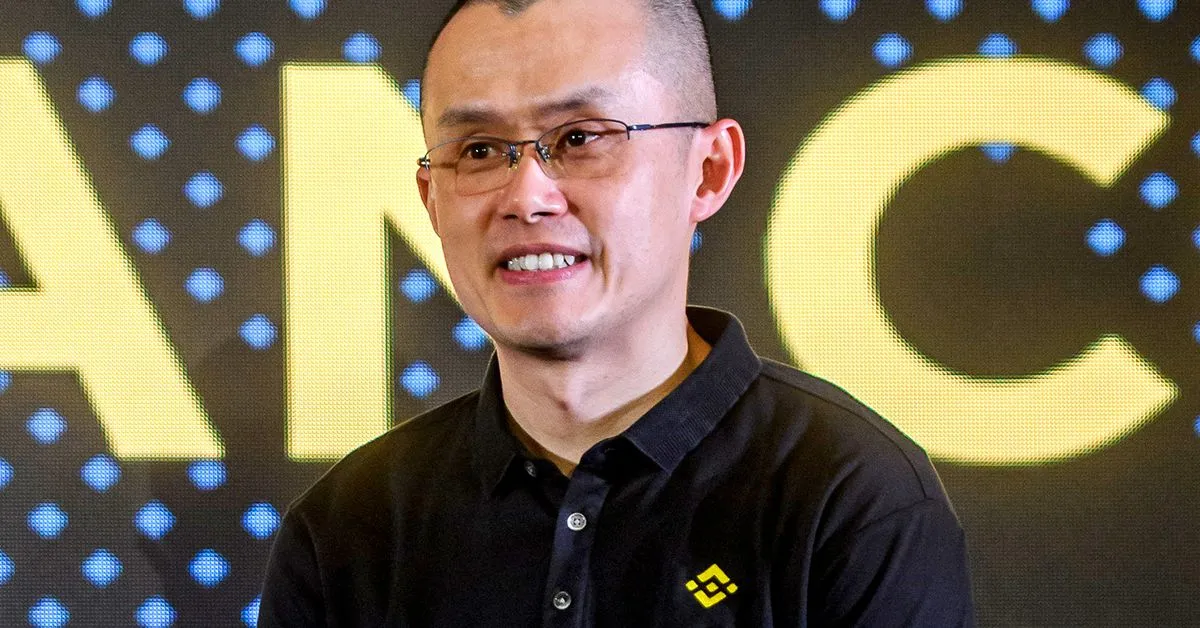

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against crypto exchange Binance, its operating company Binance.US, and its founder and CEO Changpeng CZ Zhao for allegedly violating federal securities laws. According to the suit, Binance, Binance.US and CZ offered unregistered securities to the public in the form of the BNB token and Binance-linked BUSD stablecoin. The SEC also alleged that Binance’s staking service violated securities law, and that Binance allowed U.S. persons to trade on its platform despite saying it wasn’t.

As a second part of Zhao’s and Binance’s plan to shield themselves from U.S. regulation, they consistently claimed to the public that the Binance.com Platform did not serve U.S. persons, while simultaneously concealing their efforts to ensure that the most valuable U.S. customers continued trading on the platform, the suit said.

The SEC also alleged that a number of other tokens, including the native coins for the Solana (SOL), Cardano (ADA), Polygon (MATIC), Coti (COTI) and Algorand blockchains (ALGO), Filecoin network (FIL), Cosmos hub (ATOM), Sandbox platform (AXS), Axie infinity game and Decentraland (MANA) are securities. Binance and its poor financial controls meant that customer funds were diverted, including potentially for personal uses, the suit said.

SEC Chair Gary Gensler said, Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law. Binance shared a statement on its blog, saying the company had actively cooperated with the SEC’s investigations and have worked hard to answer their questions and address their concerns, as well as work toward a settlement.