Known for governmental efficiency, the city-state of Singapore scored highest overall for the three measures it could control: regulatory structure, digital infrastructure, and ease of doing business. Despite the crypto industry’s reputation, Singapore has become a hub for some of the biggest brands in crypto, including Binance, Coinbase, and Crypto.com. With no capital gains tax, Singapore is an ideal place for the crypto affluent. A highly educated workforce and institutional fintech know-how have made Singapore a potent mix for the crypto industry. However, after the spectacular failures of its homegrown darlings, Singapore’s crypto community is licking its wounds and beginning to look to the future.

Singapore still has a strong reputation, receiving the most mentions for best crypto hub in a select CoinDesk survey. The Red Dot has all the ingredients of a strong crypto hub, with the highest rating in the world for digital infrastructure and second-highest ranking in the World Bank’s Ease of Doing Business index. In 2020, the Monetary Authority of Singapore (MAS) passed the Payment Services License Act, which attracted companies to apply for the license. Singapore is also the most competitive fintech hub in the Asia Pacific region, according to the 2023 Global Financial Centres Index.

Prakash Somosundram, founder of Enjinstarter, described having had a front-row seat to the Singaporean crypto scene since 2015. Wealthy expats have flooded into Sentosa Island, which Somosundram calls Crypto Island. Crypto meetups, conferences, and events were held in villas or even on yachts. However, CZ and Balaji, two crypto celebrities, have since moved on. Zhuling Chen, founder and CEO of staking access startup RockX, describes a racially and gender-diverse community, one that has diversified its cryptocurrency ecosystem.

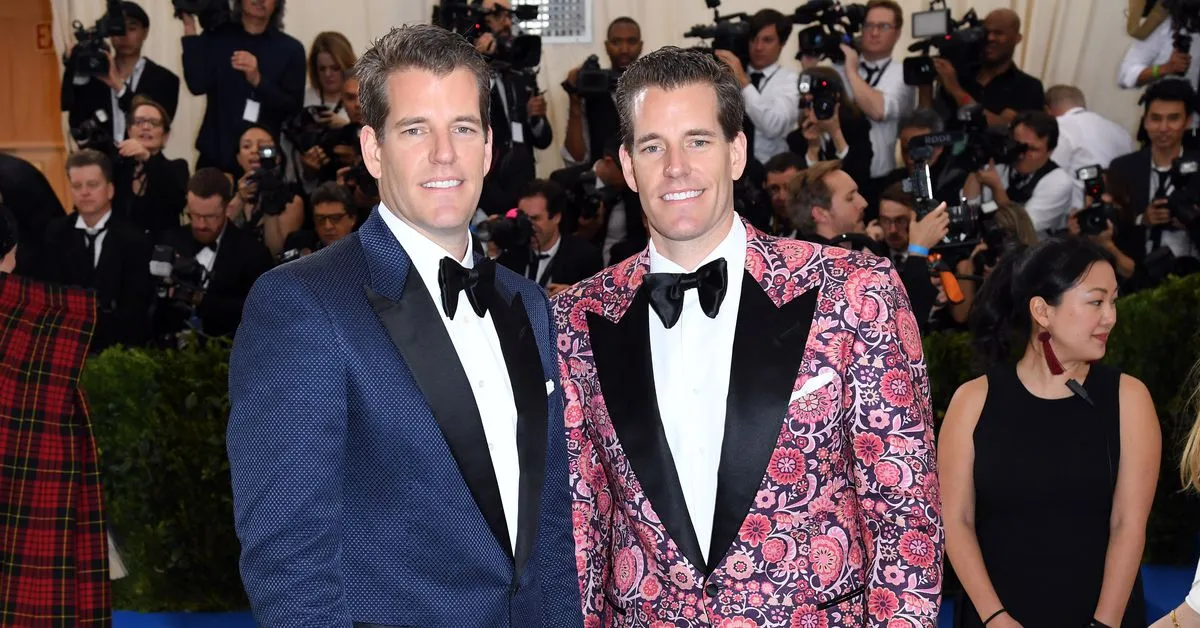

The residents of Singapore come from around the world, with roughly 30% of the population non-citizens, or expats. This has made it attractive to find good talent. However, the current Crypto Winter has made the government-owned conglomerate and VC, Temasek Holdings, write off $200 million in losses to Sam Bankman-Fried’s now-defunct FTX. This has caused a cautious posture, driving the crypto affluent to move to Dubai and Hong Kong. Cameron and Tyler Winklevoss, co-founders of crypto exchange Gemini, announced that it would increase the headcount of its Singapore outpost to over 100.

Pamela Lee, head of APAC sales at Talos, said, “We don’t want to be seen as crypto bros. What we want to be is a fintech hub that has a very innovative environment for people to collaborate and grow together.” Singapore is still maintaining its commitment in terms of promoting blockchain, but with more attention paid to know-your-customer and anti-money-laundering measures.