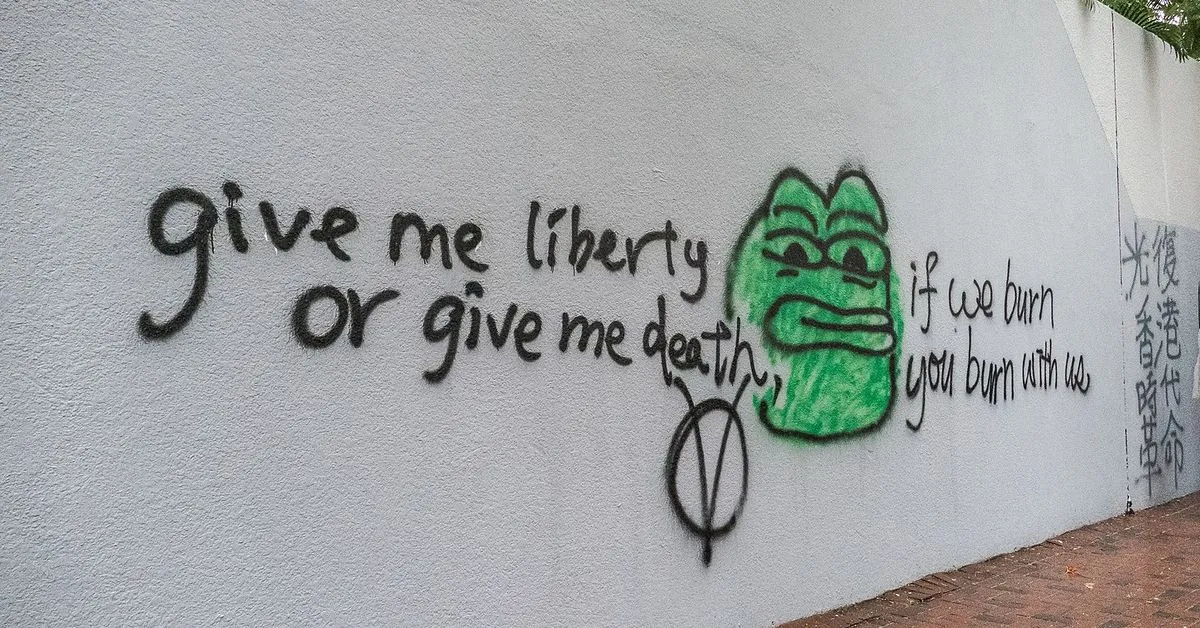

The wild journey of Pepecoin (PEPE), from joke to somewhat established project, perfectly encapsulates the excitement and unpredictability that come with this breed of digital assets. Meme coins have become a popular gateway to the world of Web3, drawing in people from all walks of life with their blend of internet humor and gambling. While these assets have the potential to drive mass adoption of decentralized technologies, they also come with a host of challenges.

The meteoric rise of meme coins – Dogecoin (DOGE), Shiba Inu (SHIB) and PEPE, to name a few – has been nothing short of a spectacle. They effectively level the playing field in the often daunting world of cryptocurrencies, sparking intrigue among anyone who may have previously viewed this realm as the exclusive territory of tech-savvy investors and financial gurus.

The allure of these coins extends beyond their comical origins or potential for quick profit. They give hope to the many people interested in Bitcoin who feel like they missed their moment to invest. However, investing in meme coins is not wise, and the best thing that could happen is that newcomers to crypto learn about the true innovation happening in Web3, the potentials of different decentralized applications (dApps) and the importance of self-custody.

In many ways, meme coins have turned passive internet users into active participants in the DeFi landscape, encouraging them to explore, learn and interact with blockchain technologies firsthand. Nevertheless, this fun, democratized on-ramp has its share of tribulations. The inherent volatility and unpredictability of meme coins is a significant concern, especially when influencers spew empty promises of astronomical returns.

Moreover, the fundamentals of these assets are often questionable. Unlike traditional blockchains such as Bitcoin or Ethereum, many meme coins lack intrinsic value or a concrete use-case, meaning their prices are fueled largely by hype rather than technological innovation or real-world utility.

The potential and inevitability of market manipulation is another issue. In the absence of regulation, meme coins can be exploited in pump-and-dump schemes, where influencers or large investors artificially inflate the price before selling off their holdings, leaving average investors to bear the brunt of the crash.

The fact that meme coins have muddied the waters of the crypto space, often leading to misconceptions and reinforcing skeptical statements such as “all crypto is a scam”, means that the general public now faces the challenge of unlearning their current understanding of blockchain and Web3.

With their dynamic blend of entertainment and investment, meme coins have left an indelible mark on the crypto space and have played a crucial role in propelling Web3 recognition to mainstream audiences. However, we must maintain a sense of focus towards the value and substance that cryptocurrency and Web3 offers.

So embrace meme coins, but don’t treat them like a joke.