Centralized stablecoins dominate cryptocurrency trading, but recent turbulence has showcased that markets heavily rely on stablecoins that lack transparency of their reserves, said Clara Medalie, head of research at Kaiko. Crypto markets are highly dependent on centralized stablecoins that often lack transparency around reserves.

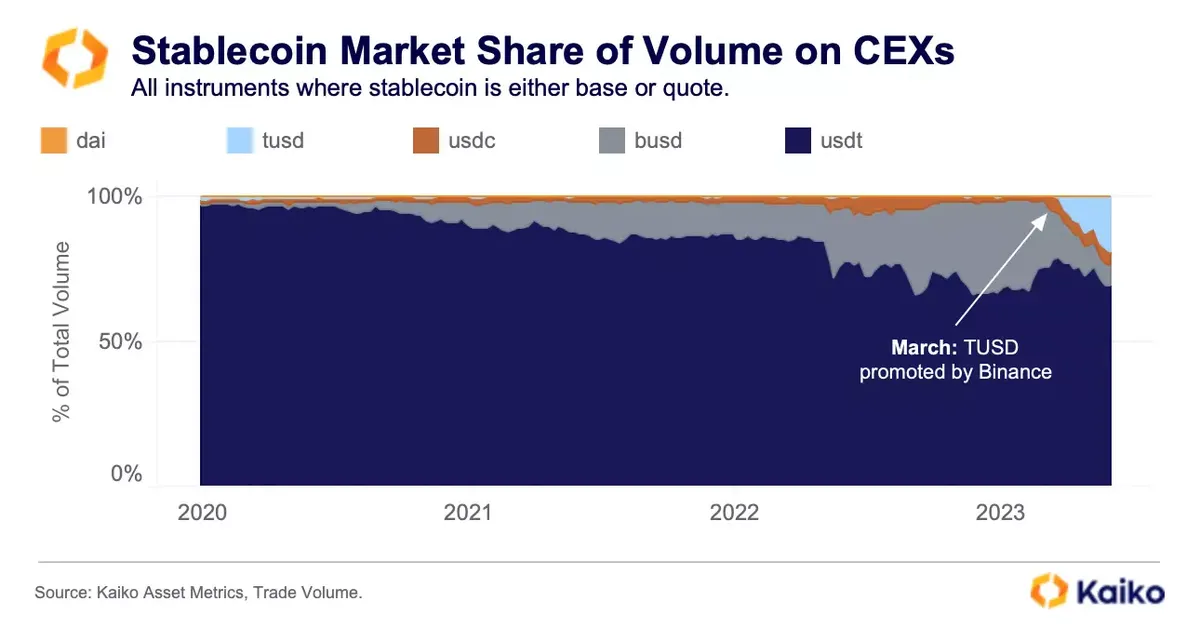

TUSD, the third largest stablecoin, has grown dramatically to 19% from less than 1% in three months. This has caused concern due to the implosion of banking partner Prime Trust and disruptions in its reserve reporting. Tether’s USDT, which was partially backed by Chinese commercial papers in the past, claimed a 70% share of volumes.

Stablecoins have become a key piece of plumbing for the crypto ecosystem, facilitating trading and onboarding from government-issued fiat currencies. The asset class has a combined market capitalization of $128 billion, per CCData.

The largest stablecoins have all endured periods of turmoil in the last few months. In February, New York state regulators ordered Paxos to halt minting Binance USD (BUSD). Next month, the collapse of Silicon Valley Bank (SVB) temporarily froze a sizable portion of USDC’s cash reserves, which affected Maker’s DAI stablecoin. Last month, USDT endured sell pressure in a key stablecoin liquidity pool, spooking traders, and TUSD weathered the implosion of its custodial partner.

TUSD is backed by fiat assets, according to Chainlink’s proof-of-reserves technology. The token’s rapid rise followed Binance’s decision to promote the stablecoin with zero-fee trading on its platform after the clampdown on BUSD earlier this year.

Recent turbulence in the crypto markets has highlighted the risks of centralized stablecoins. 74% of all transactions on centralized crypto exchanges involve stablecoins, while only 23% incorporate fiat currencies, according to Kaiko data. The largest stablecoins have all endured periods of turmoil in the last few months, with TUSD posing the biggest risk due to its lack of transparency around reserves. TUSD is backed by fiat assets, and its rapid rise followed Binance’s decision to promote the stablecoin with zero-fee trading on its platform.