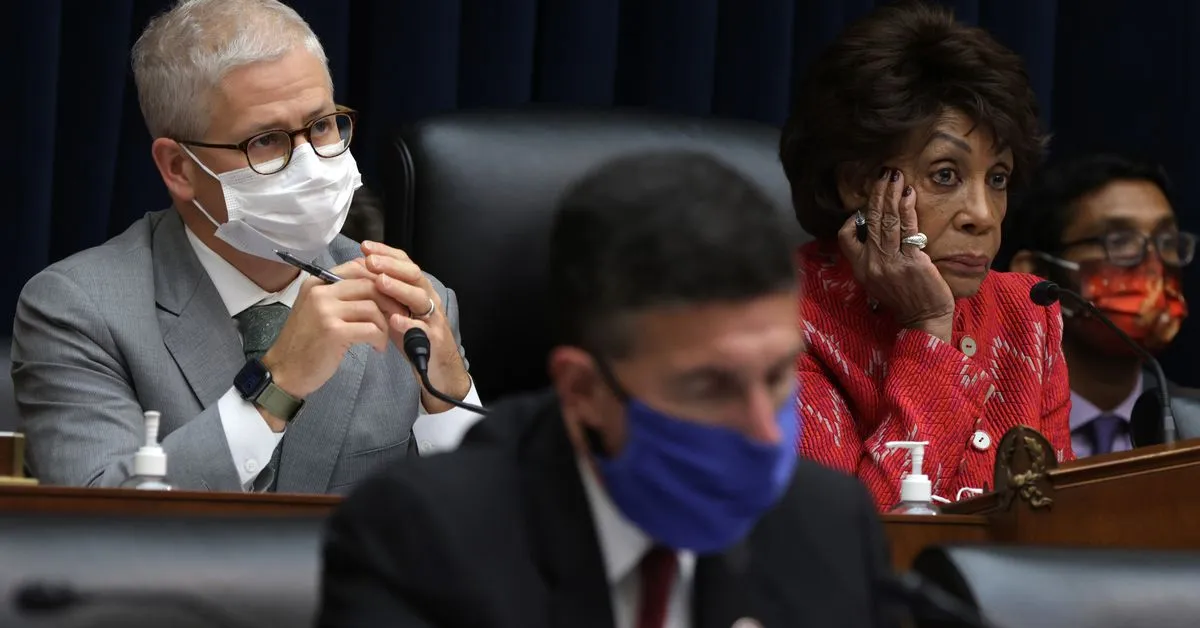

As CoinDesk made the difficult decision to let go of 24 colleagues this week, it is worth reflecting on how far ahead of the U.S. other jurisdictions are in the process of regulating stablecoins. This laggard status could mean a challenge for the dollar’s place in the future of money. U.S. Rep. Maxine Waters (D-Calif.) criticized PayPal for launching its coin before Congress had time to deliberate over a federal law, and this could make it even more likely that the House stablecoin bill dies in the Senate.

The fact that so many other places are acting constructively on this issue should be cause for concern for any policymaker charged with furthering U.S. interests globally, said Castle Ventures Partner Nic Carter. Other countries will use their head start in regulating this rapidly evolving technology to grab a share of this new field in ways that could undermine U.S. financial leadership.

The U.S. has an opportunity to turn open-access protocols and the natural demand for dollars into a new form of domination, but if the legislative process drags on, it will perpetuate the existing system of Washington-regulated, Wall Street-managed surveillance.

It’s time to act, said Carter.