A U.S. Senator, a number of crypto lobbying organizations, and a group of professors have filed amicus briefs in a federal court, urging the court to dismiss a Securities and Exchange Commission (SEC) lawsuit against crypto exchange Coinbase. The SEC had brought the lawsuit in June this year, alleging that Coinbase and other crypto trading platforms are unregistered securities exchanges, brokers, and clearinghouses trading unregistered securities in the form of crypto assets.

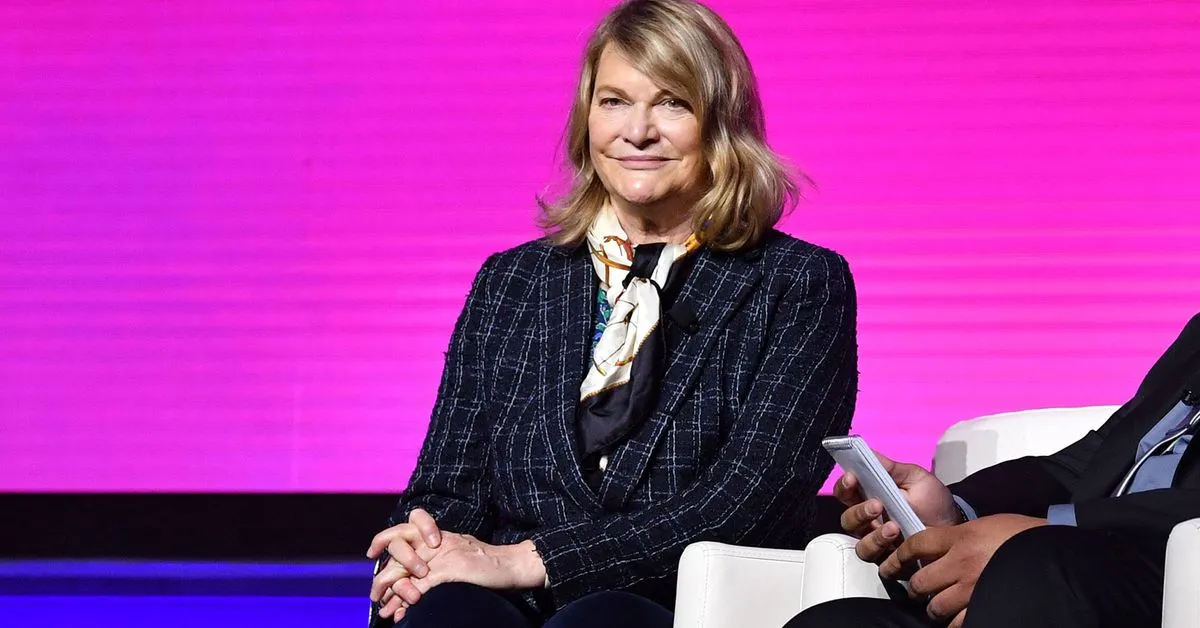

The amicus briefs, addressed to Judge Katherine Polk Failla of the U.S. District Court for the Southern District of New York, echo Coinbase’s own arguments in its motion for judgment dismissing the case. The brief filed on behalf of Senator Cynthia Lummis (R-Wy.) stated, “This is no run-of-the-mill enforcement case. Through this case, the SEC seeks primary influence over economic, political, and legal questions under active consideration by Congress and multiple agencies.”

The organizations and lawmaker argued that the SEC was trying to exceed its authority and cited the recent Supreme Court case West Virginia v. the Environmental Protection Agency, which held that regulatory agencies couldn’t broadly exceed their mandate without Congressional approval. The argument was recently rejected by another federal judge in the same court overseeing a different SEC case against a crypto platform.

The amicus briefs come a day after the SEC settled similar charges with Bittrex, another global exchange with a U.S. arm. Senator Lummis’s brief noted that lawmakers have introduced a number of bills in recent years that specifically lay out where the SEC’s jurisdiction lies, and where its sister regulator, the Commodity Futures Trading Commission (CFTC), may take over.

SEC Chair Gary Gensler has said that in his view, many crypto tokens already meet the standards for securities regulation. “They don’t just resemble securities, they are securities,” he said.