The dominance of Bitcoin (BTC), Ether (ETH) and stablecoins in the crypto market surged to its highest level since February 2021 as investors fled from smaller tokens after last week’s U.S. regulatory clampdown. According to digital asset research firm K33 Research, the combined market capitalization of the two largest digital assets and stablecoins compose 80.5% of the total cryptocurrency market valued at some $1 trillion.

The U.S. Securities and Exchange Commission (SEC) deemed multiple tokens securities in lawsuits against crypto exchanges Binance, Binance.US and Coinbase, leading to a dramatic sell-off of altcoins – an umbrella term for alternative cryptocurrencies. Top 10 crypto assets such as Binance’s BNB, Cardano’s ADA and Solana’s SOL lost as much as 30% of their value over the week.

If the SEC’s allegation about a slew of tokens being securities is proven right, token issuers and exchanges would face a mounting burden to register with the SEC. This could limit liquidity further onwards and lead to a prolonged slow market, according to K33. The legal battle could drag on for years, impeding capital inflows to the assets under SEC scrutiny and propelling the investment case for BTC and ETH as safer bets from regulatory risks.

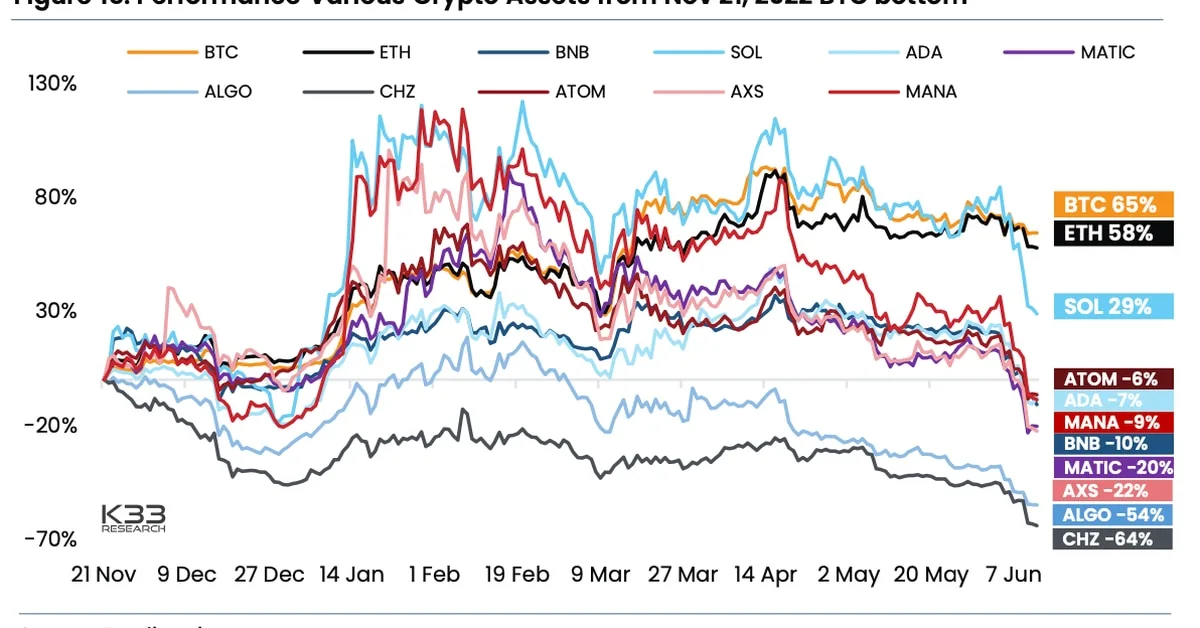

The two leading cryptos have outperformed smaller tokens this year so far, preserving much of their gains from this year’s crypto market recovery. BTC and ETH are up 57.3% and 45.4% year-to-date, respectively, according to market data. Other cryptocurrencies, however, dropped to new yearly lows, with BNB and MATIC tumbling 2.7% and 15%, respectively, since the start of the year.

The crypto market has seen a surge in the dominance of Bitcoin, Ether and stablecoins as investors seek safety from regulatory risks. According to K33 Research, the combined market capitalization of the two largest digital assets and stablecoins compose 80.5% of the total cryptocurrency market valued at some $1 trillion. The U.S. Securities and Exchange Commission (SEC) deemed multiple tokens securities in lawsuits against crypto exchanges, leading to a dramatic sell-off of altcoins. This could limit liquidity further onwards and lead to a prolonged slow market, according to K33.

BTC and ETH have outperformed smaller tokens this year so far, preserving much of their gains from this year’s crypto market recovery. Other cryptocurrencies, however, dropped to new yearly lows.