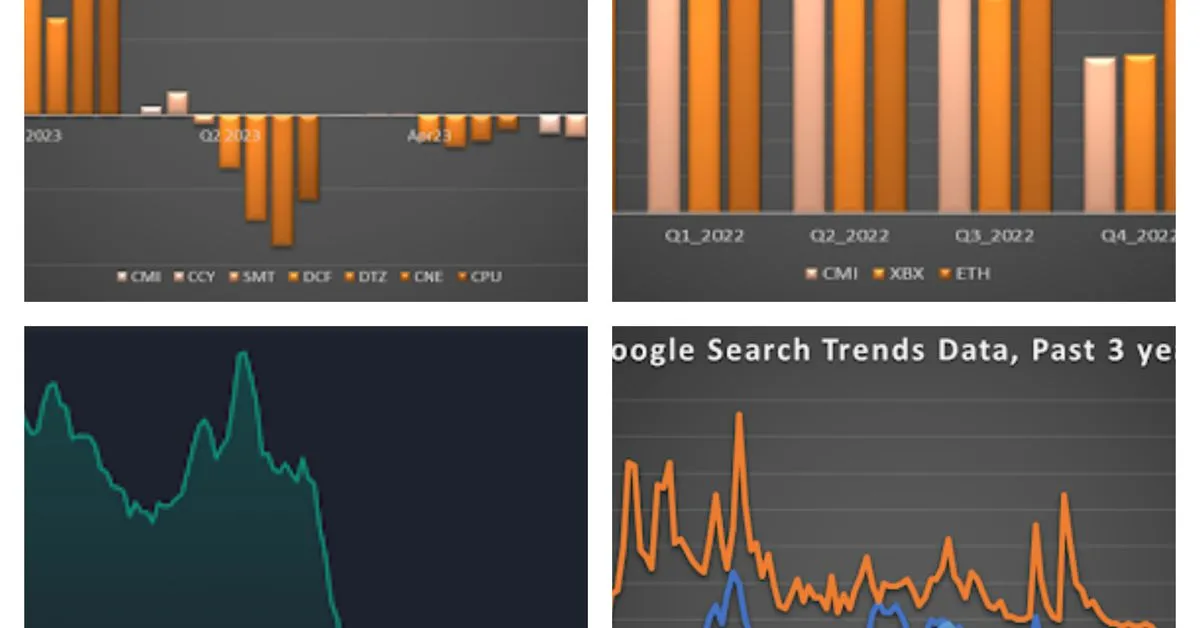

The cryptocurrency market experienced a choppy ride in the second quarter of 2023, with the CoinDesk Market Index (CMI) appreciating by 2.2%. Bitcoin (BTC) and Ether (ETH) outperformed the broad benchmark, with gains of 7% and 5.2%, respectively. According to CoinDesk, “The underperformance in the CMI, relative to BTC and ETH can be largely attributed to the quarter which saw significant regulatory action against large-cap alternative tokens, combined with positive developments for Bitcoin, resulting in a bifurcation in the crypto market between Bitcoin and Ether versus all other digital assets.”

The Currency (CCY) and Smart Contract Platform (SMT) sectors, which contain Bitcoin and Ether, respectively, outperformed the Digitization (DTZ) and Culture and Entertainment (CNE) sectors. April and May were relatively muted months, with the market trading within a price range established after the response to the Silicon Valley Bank collapse in March. This range-bound market also exhibited lower than average realized volatility, with Q2 2023 exhibiting the lowest volatility quarter for CMI, Bitcoin (XBX) and Ether (ETH) in the past 2 years.

In May, the asset class saw some slight weakness due to macro headwinds of rising interest rate expectations. June saw the lows of the range tested by the Binance and Coinbase SEC announcements, then later the highs with the announcement of the BlackRock filing of a Bitcoin spot ETF. This Bitcoin positive development, combined with the SEC action against Coinbase, resulted in an increase in the ratio of Bitcoin Market Cap to Total Crypto Market Cap (“Bitcoin Dominance”).

Monthly crypto exchange trading volume and Google Search Trend data have not recovered to 2020-2021 levels, which suggests that retail interest in crypto continues to stagnate. With the recent flurry of Bitcoin Spot ETF filings, and newer institutional exchange offerings, we can hope that this interest gets revitalized by new institutional entrants into the market.

Within our suite of CoinDesk Indices indicators, both Bitcoin and Ethereum Trend Indicators are currently estimating strong upward trends and are suggestive of a move towards higher prices from current levels. However, this should be weighed against a substantially inverted US yield curve, which is the most inverted since the early 1980s.