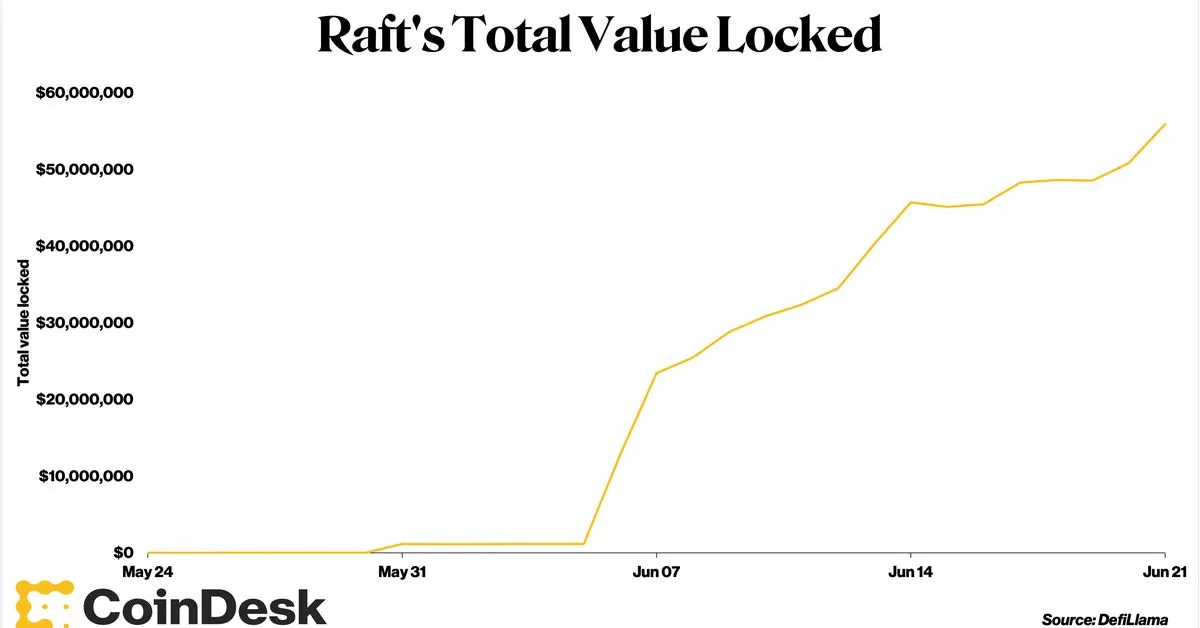

Raft, a stablecoin issuer whose flagship token is backed by staked ether (stETH) from Lido, has seen its Total Value Locked (TVL) reach $55 million, a sign of strength for the roughly three-week-old protocol. According to blockchain statistics firm DefiLlama, Raft’s TVL has increased 4,595% since June 5, while other protocols building stETH-backed stablecoins have stalled. For example, Lybra’s TVL remains around $180 million, while its eUSD stablecoin has a market cap of $84 million, and Raft’s R sits at $29 million.

Raft’s surge highlights the booming market for liquid staking tokens, which enable users to maintain liquidity despite locking their ether to earn rewards for securing the Ethereum blockchain. The liquid staking sector has a combined TVL of more than $20 billion, making it the top dog in the DeFi space. “LSDFi will continue to dominate the DeFi space over the next few months and beyond,” Raft CEO David Garai told journalists.

Garai also noted that Raft “will be adding other staking derivatives as collateral over the next few weeks,” which he predicted would further increase TVL “significantly.” In addition, the team has had ongoing conversations about introducing RAFT, an additional token intended to empower community members and help decentralize the protocol.